EUR/USD: The Fed’s Doves Have Became Hawks Once more

● After the US Federal Reserve and ECB conferences, the DXY Greenback Index fell to a brand new 9-month low of 100.80 on February 02. This occurred after the dovish hints of the pinnacle of the Fed, Jerome Powell, who, throughout a press convention following the assembly, admitted for the primary time that “the deflationary course of has begun.” The market has determined that that is the start of the tip, and that the tip of the bullish wave is close to.

However hints aren’t particular guarantees. Particularly from the heads of the US Central Financial institution. And now, talking on the Washington Financial Membership, Jerome Powell is saying that rates of interest should proceed to rise with the intention to management inflation. And he makes a hawkish trace that the height charges could also be greater than the markets anticipate. And even greater than the Fed’s personal forecasts, introduced in December.

Powell’s hawkish angle was supported by New York Federal Reserve Financial institution (FRB) President John Williams, Fed Board of Governors Christopher Waller, and Minneapolis Fed Chairman Neil Kashkari. The latter mentioned that the Fed nonetheless has loads of work to do to curb inflation. This might imply that the rate of interest might be raised from the present 4.75% all the way in which as much as 5.40% or greater and keep at that prime for fairly a while.

This time, the market determined that it was not value ready for an early easing of financial coverage, and the greenback started to achieve power. The DXY index reached a five-week excessive at 103.96 factors on Tuesday, February 07. Nonetheless, it couldn’t rise greater, because it met a number of pretty robust resistance ranges without delay: 1) the 50-day SMA, 2) the previous pattern line from 2021, 3) the higher restrict of the descending channel, which started in November 2022, in addition to horizontal resistance within the 104.00 zone.

● The previous 5 days had been stingy with macro statistics, however wealthy in statements by each American and European officers (the EU leaders summit happened on February 09-10). The following week guarantees to be richer in financial information. January information on US client inflation (CPI) will likely be revealed on Tuesday, February 14. The forecast assumes that costs rose by 0.4-0.5% in January (0.1% in December). On the similar time, annual information could transform decrease than the earlier worth (6.2% vs. 6.5%). If the CPI exhibits that inflation is steady, this can affirm the newest hawkish statements by Fed officers and help the greenback. (Scotiabank economists consider that EUR/USD could fall to 1.0500-1.0600). If there’s a regular decline in inflation, the US forex will likely be beneath severe stress.

● Having reached a excessive of 1.1032 on February 02 (the very best since April 2022), EUR/USD reversed and ended the week at 1.0679. 35% of analysts anticipate an additional strengthening of the greenback on the time of writing the assessment (on the night of February 10), 20% anticipate the euro to strengthen, and the remaining 45% have taken a impartial place. The image is totally different among the many indicators on D1. 85% of the oscillators are coloured purple (a 3rd are within the oversold zone), whereas the remaining 15% are inexperienced. Amongst pattern indicators, 40% advocate shopping for, 60% – promoting. The closest help for the pair is within the zone 1.0670, then there are ranges and zones 1.0620, 1.0560, 1.0500, 1.0440 and 1.0370-1.0400. The bulls will meet resistance within the space of 1.0700-1.0710, 1.0745-1.0760, 1.0800, 1.0865, 1.0895-1.0925, 1.0985-1.1030, 1.1110, after which they may attempt to acquire a foothold within the 1.1260-1.1360 echelon.

● Among the many occasions of the upcoming week, along with the discharge of the inflation information talked about above, we are able to observe the publication of preliminary information on Eurozone GDP on Tuesday, February 14. (And naturally, we should not overlook that February 14 is St. Valentine’s Day, essentially the most romantic vacation celebrated in most nations of the world. Folks confess their love to one another on this present day, for a couple of and a half thousand years). Retail gross sales within the US will turn into recognized on Wednesday, February 15, and information on US unemployment will come on Thursday, February 16. The January US Producer Value Index (PPI) can even be launched on February 16.

GBP/USD: Coming Week: Volatility Assured

● The pound tried to win again a part of its losses final week. GBP/USD, having rebounded on February 07 from the extent of 1.1961 (the bottom stage since January 06), reached a weekly excessive of 1.2193 on February 09. Then, the pound started to step by step retreat in opposition to the greenback together with different currencies included within the DXY Index. Because of this, GBP/USD ended the week at 1.2055, that’s, nearly the place it began (1.2050).

● The information background nonetheless appears imprecise and unsure. Financial issues proceed to place stress on the British forex. Recall that within the struggle in opposition to inflation, the Financial institution of England (BoE) raised the important thing price by 50 bp on February 2 to 4.00%, however on the similar time softened its message noticeably. This pushed the British forex down from its highest values since mid-June 2022 (1.2450) by greater than 250 factors.

Market individuals consider that the BoE could also be afraid of additional sharp price hikes. It’s one other query how its development will have an effect on inflation. However it might effectively provoke a disaster within the economic system and, above all, within the building sector. January information on the index of enterprise exercise within the building sector of the nation had been revealed on Monday, January 06, having proven a drop on this indicator from 48.eight to 48.Four factors. The Workplace for Nationwide Statistics of the UK reported on Friday, February 10 that all the economic system of the nation in December, with a forecast of minus -0.3%, really shrank by -0.5% (there was a rise of +0.1% in November). GDP stagnated at 0% in This autumn, after falling by -0.2% 1 / 4 earlier. GDP fell from +1.9% to +0.4% in annual phrases.

● In opposition to this background, the triumphant stories and optimistic forecasts from the UK Treasury Secretary Jeremy Hunt sounded considerably unusual. The excessive official mentioned that “the UK was the quickest rising economic system within the G7 final 12 months and prevented a recession as effectively”. This exhibits that “the economic system has confirmed to be extra resilient than many feared.” And “if we stick with our plan to chop inflation by half this 12 months,” continued Jeremy Hunt, “we are able to ensure that we may have among the finest development prospects of any nation in Europe.”

● Not like Mr. Hunt, Commerzbank strategists consider that uncertainty about future inflation within the UK stays excessive. The dynamics and values of the Shopper Value Index, which will likely be revealed on Wednesday, February 15, can carry some readability. It’s the CPI that’s the key indicator that determines the longer term financial coverage of the Financial institution of England. In fact, information on the state of the labor market, which will likely be launched the day earlier than, on Tuesday, February 14, and on retail gross sales within the UK, which can turn into recognized on February 17, can even be necessary.

● All these macroeconomic statistics are certain to trigger elevated volatility in GBP/USD. Within the meantime, 40% of analysts anticipate additional weakening of the pound, the identical quantity want to chorus from forecasts and look forward to the discharge of particular indicators. Solely 20% of specialists vote for the strengthening of the pound and the expansion of the pair. Among the many pattern indicators on D1, the stability of energy is 75% to 25% in favor of the reds. Among the many oscillators, the purple ones have a 100% benefit, nevertheless, 10% of them give indicators that the pair is oversold. Help ranges and zones for the pair are 1.2025, 1.1960, 1.1900, 1.1800-1.1840. When the pair strikes north, it would face resistance on the ranges 1.2085, 1.2145, 1.2185-1.2210, 1.2270, 1.2335, 1.2390-1.2400, 1.2430-1.2450, 1.2510, 1.2575-1.2610, 1.2700, 1.2750 and 1.2940.

USD/JPY: The Head of BOJ Is New, the Coverage Is Previous.

● The Japanese yen, like its DXY counterparts, reacted each to the hawkish statements of the US Federal Reserve and to fluctuations in US Treasury yields final week. Nonetheless, the most important surge in volatility was the information that the Cupboard of Ministers intends to appoint 71-year-old Kazuo Ueda as the brand new governor of the Financial institution of Japan (BOJ).

This former professor on the College of Tokyo is a well known financial coverage skilled. He joined the Board of Governors of BOJ 1 / 4 of a century in the past, in April 1998 and remained there till April 2005. Ueda spoke out in opposition to the Central Financial institution’s abandonment of the coverage of zero charges in 2000, and the selection of his candidacy was in all probability as a result of want of the authorities to see an individual on the head of the Financial institution of Japan who wouldn’t rush to curtail the ultra-soft financial coverage. That is confirmed by Ueda himself, who acknowledged on February 10 that the present coverage of the regulator is sufficient, and that it’s essential to proceed to stick to it.

● USD/JPY ended final week at 131.39, the place it has been many occasions since December 20, 2022. In keeping with nearly all of analysts (55%), the yen could strengthen considerably within the three-month interval, however the vary of targets right here is sort of giant. Some consider that the Fed will lastly return to the doves’ camp, after which USD/JPY will be capable of attain the 120.00 zone, whereas others contemplate the vary of 127.00-128.00 to be the restrict of the autumn.

As for the quick time period, solely 20% of specialists vote for the pair to go down, 30% vote for its development, and 50% have determined to not make any predictions in any respect. Among the many oscillators on D1, 80% level north, 10% look south, and 10% level east. For pattern indicators, 40% look north, and 60% look in the other way. The closest help stage is positioned at 131.25 zone, adopted by ranges and zones 130.50, 129.70-130.00, 128.90-129.00, 128.50, 127.75-128.10, 127.00-127.25 and 125.00. Ranges and resistance zones are 131.85-132.00, 132.80-133.00, 133.60, 134.40 after which 137.50.

● Japan’s preliminary GDP information will likely be launched subsequent week, on Tuesday, February 14. It’s anticipated that the nation’s economic system will develop +0.5% in This autumn 2022 (down -+0.2% 1 / 4 earlier). The info already revealed additionally look constructive. Financial institution lending in January was greater than anticipated (+2.6%) and truly elevated by +3.1% (+2.7% in December). The Eco Watchers Present Scenario Index additionally elevated, rising from 47.9 to 48.5 factors by the tip of January.

CRYPTOCURRENCIES: Ought to Bitcoin “Take a Break”?

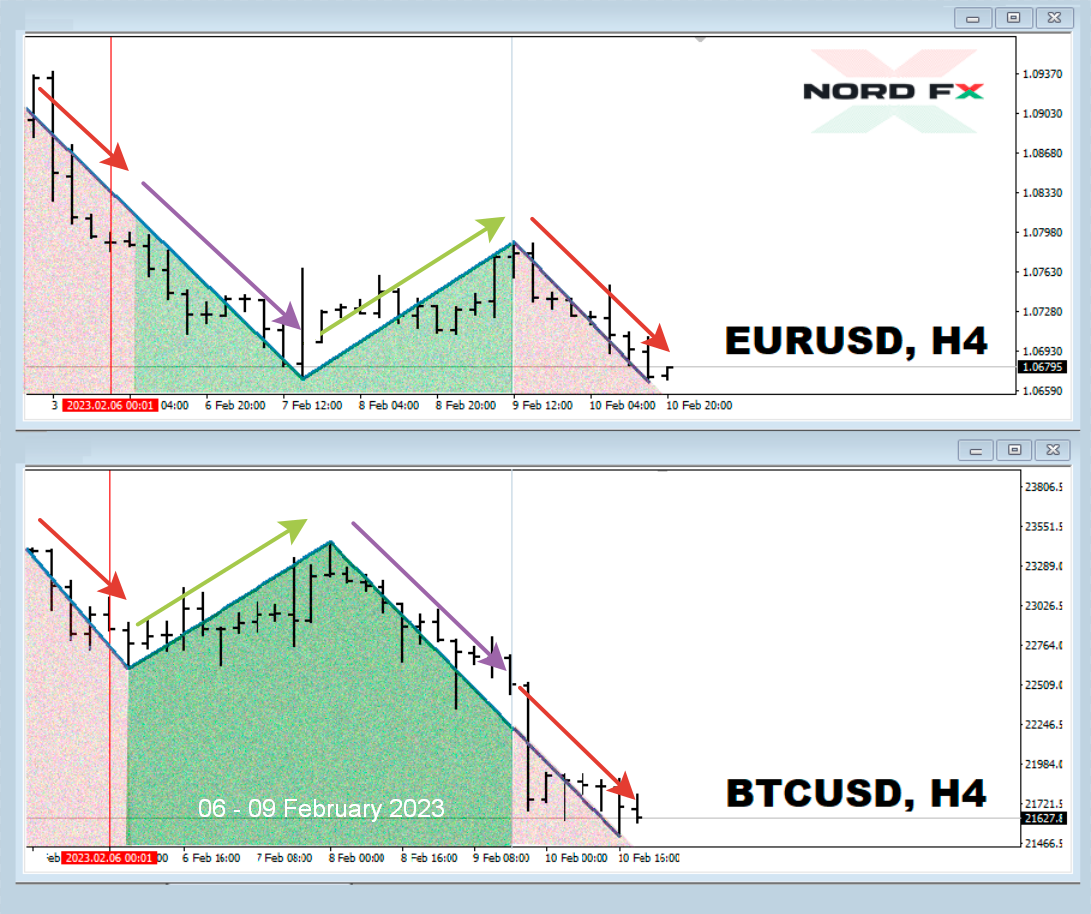

● Bitcoin’s correlation with the inventory market (S&P500, Dow Jones, Nasdaq) and different dangerous belongings is nothing new. However digital gold unexpectedly confirmed not an inverse, however a direct correlation with the US forex final week. That is clearly seen if we evaluate the BTC/USD and EUR/USD charts. Each belongings had been getting heavier or lighter, on the similar time. Drawing an analogy with a stability scale, we noticed a bodily paradox the place each bowls go up and fall down on the similar time. It was solely on the finish of the working week that the legal guidelines of physics started to work once more: the greenback strengthened a bit of, bitcoin weakened.

● The upward momentum that raised the primary cryptocurrency from a low of $16,272 in November 2022 to $24,244 within the first days of February 2023 has step by step pale away. BTC/USD has returned to the place it was within the second half of January, and the results of the final three and a half weeks may be thought-about near zero.

As famous by well-known dealer and investor Tone Vays, bitcoin has “grown very quick and really excessive” and is now going through severe resistance because it approaches the $25,00Zero stage. The specialist believes that the asset will ultimately break by this resistance zone, nevertheless it in all probability “ought to take a break now.” Vays clarified that he expects both the consolidation of the speed in a slim vary, or a small pullback.

This skilled will not be alone in his evaluation. In keeping with statistics, the media forecast of crypto neighborhood members precisely predicted the worth of bitcoin by the tip of every month, over the previous six months with a likelihood of as much as 75%. Finbold specialists launched the outcomes of the newest survey of greater than 15 thousand merchants and predictions of machine studying algorithms. Actual folks anticipate BTC quotes to fall to $20,250 by February 28, 2023, synthetic intelligence factors to $24,342.

Such a small (by bitcoin requirements) vary of fluctuations corresponds fairly precisely to Vays’ prediction of a “breather”. The market state of affairs is sort of unsure in the intervening time, and whereas short-term holders have returned to the worthwhile zone, long-term holders (holding for six months) nonetheless stay within the purple zone. It took 291 days for all of the metrics to show inexperienced within the final bearish section, solely 268 have handed now.

● Most buyers went into the purple on the finish of final 12 months. Thus, MicroStrategy recorded a stability sheet (unrealized) lack of $1.Three billion for 2022, because of its long-term investments in bitcoin. (As of December 31, 2022, MicroStrategy held a complete of 132,500 BTC value $1.84 billion). On the similar time, the corporate’s administration doesn’t plan to cease operations with a digital asset. Commenting on final 12 months’s turmoil, MicroStrategy co-founder Michael Saylor mentioned he sees this as a form of Darwinian idea: weak and dangerous gamers have left the market, and this could push the business ahead in the long term. On the similar time, in line with Saylor, cryptocurrencies want a transparent regulatory framework for firms to adjust to sure requirements and defend clients. “What is absolutely wanted is supervision. Clear steering from Congress is required for the business to have its personal Goldman Sachs, Morgan Stanley and BlackRock. We’d like clear guidelines of conduct from the SEC (Securities and Alternate Fee) of the US.”

Nonetheless, David Marcus, former Meta blockchain government and former PayPal president, for instance, doubts that legislatures will be capable of develop such guidelines anytime quickly. Based mostly on this, he believes that crypto firms will proceed to function in a “vacuum” in 2023, at their very own peril and threat, and the crypto winter will finish solely by 2025, when the market recovers from final 12 months’s shocks.

● Surprisingly, not solely supporters of cryptocurrencies, but in addition their fierce opponents advocate elevated regulatory stress. Thus, Charlie Munger, an affiliate of Warren Buffett, vp of the Berkshire Hathaway holding firm, referred to as on the US authorities to destroy bitcoin, which the billionaire compares investing in to playing. He mentioned in an interview with the Wall Road Journal that the cryptocurrency business is undermining the soundness of the worldwide monetary sector. And that BTC can’t be thought-about an asset class because it has no worth.

Munger has been expressing this perspective over the previous few years. And now he calls on the US authorities to deal a devastating blow to the crypto market. In his opinion, it’s essential to drive it into such a strict framework of regulation that may lastly strangle this business.

Be aware that Charlie Munger is 99 years outdated, which, maybe, explains his radical conservatism. The youthful technology of businessmen is extra loyal to digital improvements. Suffice it to recall the outcomes of a survey performed by the monetary consulting firm deVere Group. They confirmed that regardless of the challenges of 2022, 82% of millionaires had been contemplating investing in digital belongings. In keeping with Nigel Inexperienced, CEO of the deVere Group, the momentum for such curiosity will enhance as situations within the conventional monetary system change.

● Morgan Creek funding firm CEO Mark W. Yusko believes that favorable macroeconomic situations will result in the truth that the following bull market might start as early as Q2 2023. In keeping with the highest supervisor, the US Federal Reserve is unlikely to chop the important thing price within the close to future. Nonetheless, even a slowdown or pause on this course of will likely be perceived as a constructive sign for dangerous belongings, which embrace cryptocurrencies. The CEO of Morgan Creek pointed to the expectations of the following bitcoin halving, which can tentatively happen on April 19-21, 2024, as an extra cause for the expansion of the crypto market. In keeping with Yusko’s calculations, the restoration of the digital asset market often begins 9 months earlier than this occasion, which implies that the rally will begin on the finish of the summer season of 2023 this time.

● Cathie Wooden, the pinnacle of ARK Make investments, is much more optimistic concerning the future, she nonetheless considers the primary cryptocurrency to be the very best type of safety in opposition to monetary losses. In her opinion, all segments of the inhabitants, each the poor and the rich, will profit from using digital gold. In affirmation of the phrases of their supervisor, Ark Make investments analysts make only a cosmic forecast. Their pessimistic situation assumes that the BTC worth will rise to $259,000, and the optimistic one – as much as $1.5 million per coin. (we marvel what Charlie Munger would say about this?)

● On the time of scripting this assessment (Friday night, February 10), BTC/USD is buying and selling within the $21,600 zone. The whole capitalization of the crypto market is $1.010 trillion ($1.082 trillion every week in the past). The Crypto Worry & Greed Index fell from 60 to 48 factors over the week, and ended up within the Impartial zone, nearly within the very heart of the dimensions. The state of affairs is unsure, and maybe merchants, like bitcoin, “ought to take a break”?

NordFX Analytical Group

Discover: These supplies should not funding suggestions or pointers for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in a whole lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx