The Euro retreated close to the 1.0940 resistance stage talked about in our earlier report as a result of profit-taking forward of the weekly shut.

Trying on the short-term value motion, we are able to see that the pair is buying and selling in an uptrend. Nevertheless, within the coming hours, we’d see a continuation decrease within the route of the 1.0800-1.0760 zone which is more likely to act as assist earlier than seeing a bounce. Subsequently, the present retracement is anticipated to be restricted if the Euro continues to carry above the 1.0700 stage.

As well as, the only foreign money managed to overhaul the falling trendline as per the chart beneath, which retains the bullish momentum intact.

To conclude, a brief drop is extremely anticipated within the Euro adopted by a continuation larger after reaching the assist zone highlighted above.

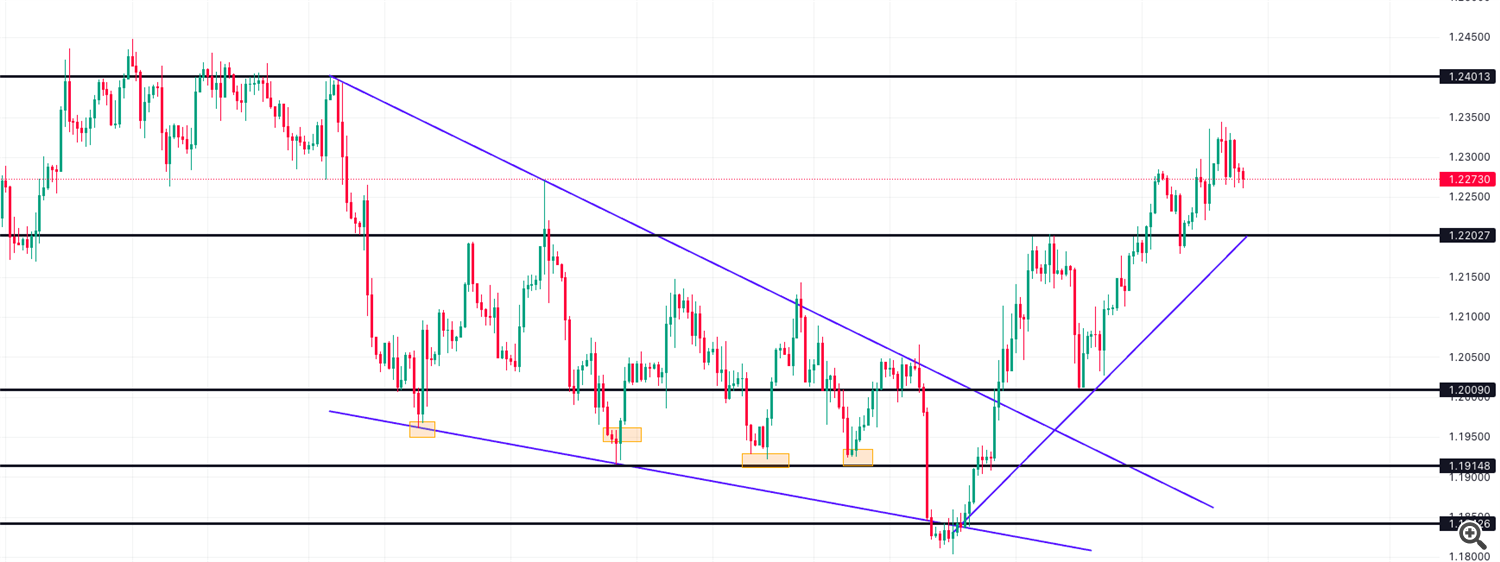

The British pound retreated yesterday as sellers pushed costs decrease following the Financial institution of England price determination.

As of now, the momentum stays optimistic, and any potential decline is anticipated to face new consumers from the 1.2220-1.2180 assist zone. From a wider angle, the pattern is more likely to keep to the upside within the coming days if the pair manages to carry above the 1.2010 low registered final week.

On the alternative, a continuation larger ought to goal the subsequent barrier on the 1.2340 stage adopted by key resistance at 1.2400 which represents the February excessive.

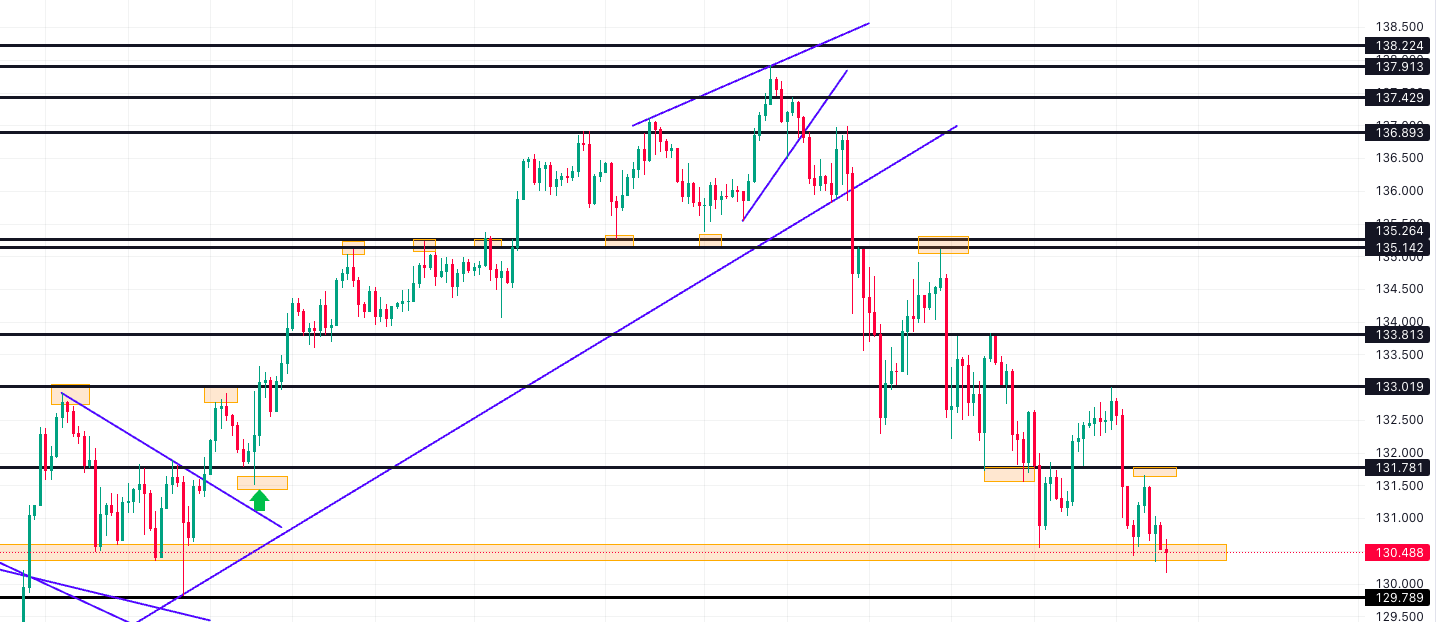

This pair traded in keeping with our expectations after costs didn’t overtake the hourly resistance of 131.80 which retains the draw back stress intact.

From a technical standpoint, the pattern is down, and sellers are anticipated to problem the hourly assist of 1.3050. Furthermore, the pair is exhibiting a sequence of decrease highs and decrease lows for the reason that starting of this month, reinforcing the bearish momentum.

From an intraday perspective, essential resistance is situated on the 131.00 stage whereas the 130.50 is more likely to proceed appearing as the principle assist, in the meantime, a break beneath it ought to expose the subsequent assist at 129.80 within the coming hours.

Within the brief time period, we’d see a restricted retracement earlier than new sellers seem.

Lastly, any bounce is more likely to be non permanent whereas costs stay beneath the 131.00 resistance.

The pair dropped beneath the 1.3650 hourly assist initially, nevertheless, consumers succeeded to push costs again up and now we have seen an in depth on the optimistic territory above the 1.3700 stage which indicators that the current breakdown was not legitimate.

Trying on the chart beneath, we are able to see that demand is growing and costs are more likely to prolong larger towards the 1.3750-1.3775 resistance zone.

Within the close to time period, we are able to see that costs are buying and selling sideways inside a spread situated between the 1.3810 excessive and 1.3630 low, consequently, merchants ought to look forward to a transparent break exterior of this band for future

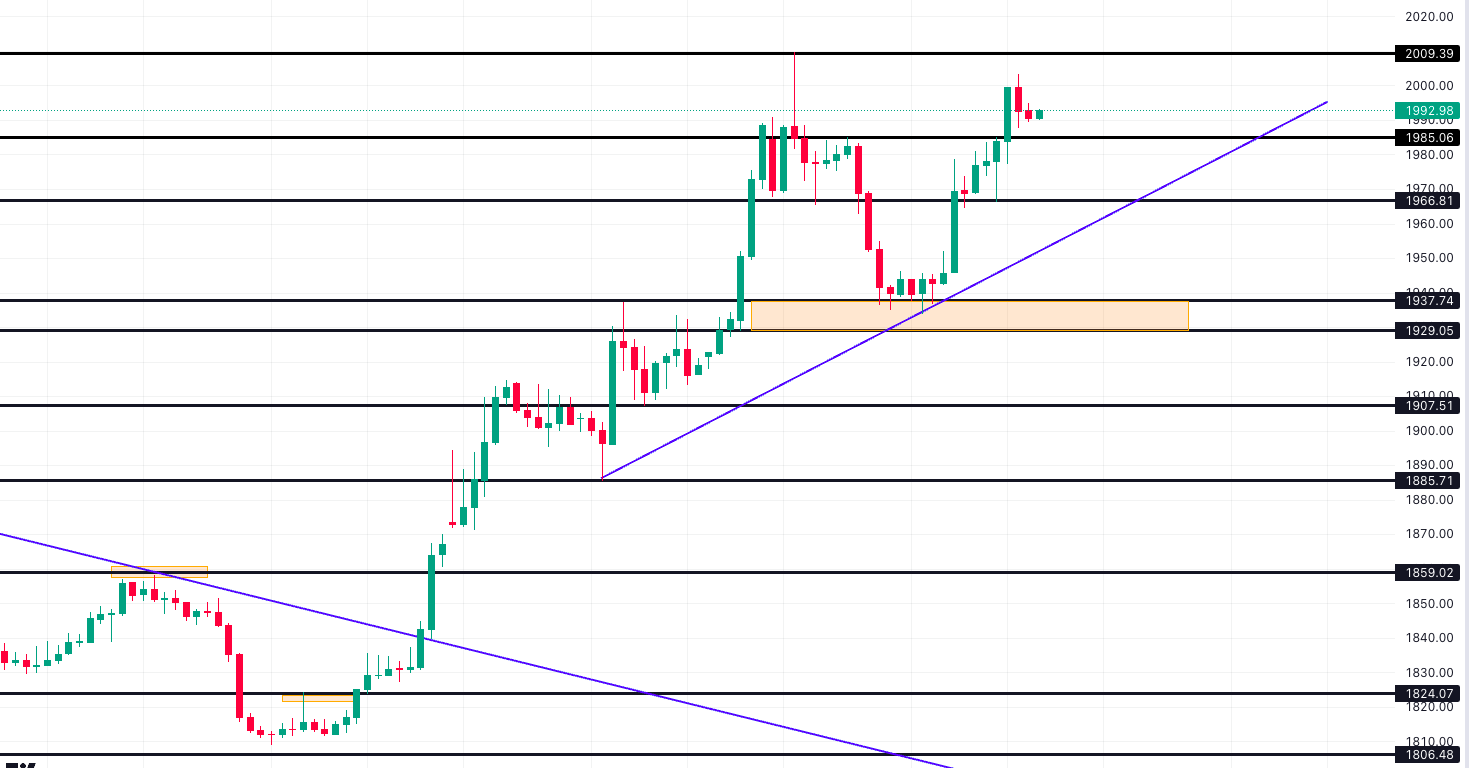

Gold prolonged its advance yesterday because the bullish momentum stay robust.

The yellow metallic managed to overhaul the short-term barrier of $1985 and stabilized above it, which reinforces the bullish outlook. On the identical time, costs want to interrupt above this week’s excessive of $2010 to clear the trail for an additional rally.

Within the coming hours, we’d see value stabilization, within the meantime, consumers are anticipated to maintain management if costs handle to carry above the 1967 assist. Solely a day by day shut beneath this assist ought to weaken the present uptrend.

Furthermore, merchants ought to control the rising trendline to evaluate the energy of the prevailing uptrend.

Automate your buying and selling with our Robots and Utilities

Scalper ICE CUBE MT4 – https://www.mql5.com/en/market/product/77108

Scalper ICE CUBE MT5 – https://www.mql5.com/en/market/product/77697

EA Lengthy Time period MT4 https://www.mql5.com/en/market/product/92865

EA Lengthy Time period Mt5 https://www.mql5.com/en/market/product/92877

Utility ⚒

EasyTradePad MT4 – https://www.mql5.com/en/market/product/72256

EasyTradePad MT5 – https://www.mql5.com/en/market/product/72454

Danger supervisor MT4 – https://www.mql5.com/en/market/product/72214

Danger supervisor MT5 – https://www.mql5.com/en/market/product/72414

Indicators 📈

three in 1 Indicator iPump MT4 – https://www.mql5.com/en/market/product/72257

three in 1 Indicator iPump MT5 – https://www.mql5.com/en/market/product/72442

Energy Reserve MT4- https://www.mql5.com/en/market/product/72392

Energy Reserve MT5 – https://www.mql5.com/en/market/product/72410