In fashionable buying and selling, there are three essential approaches to constructing buying and selling techniques:

- Charting Techniques: In these techniques, buying and selling choices are primarily based on visible evaluation of worth charts displayed on a monitor display.

- Computational Techniques: This class contains varied knowledgeable advisors primarily based on indicators, neural algorithms, and different computational strategies

- Information-Based mostly Techniques: These techniques depend on analyzing international tendencies, information occasions, insider info, and different elements to make buying and selling choices.

In fact, merchants can mix these info sources, however sometimes they have a tendency to decide on one main method and use others as supporting instruments.

Personally, I belong to the primary kind of merchants preferring to commerce primarily based on what they see on the charts. I imagine it permits for extra exact entry and exit factors, as it’s simpler to set pending orders.

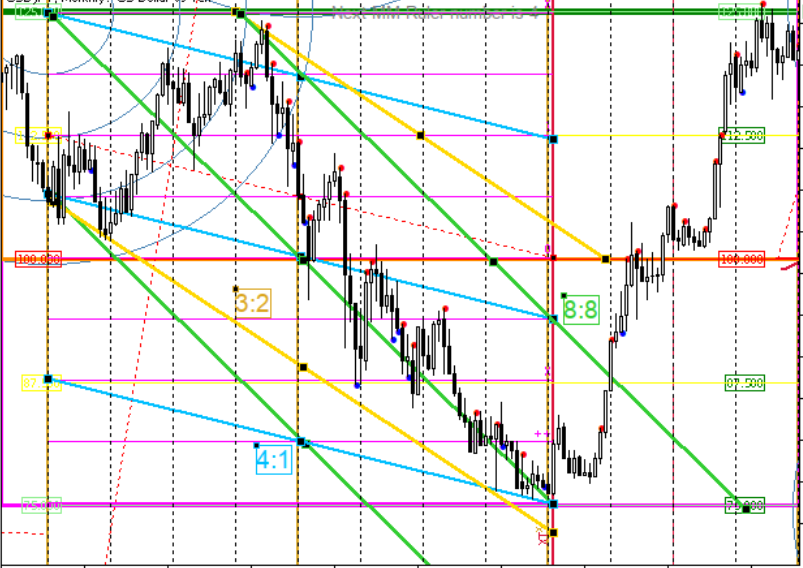

Any charting system depends on visible reference factors, corresponding to worth and time ranges.

Now, I wish to focus on some strategies of establishing such visible reference ranges.

In fashionable buying and selling, there are several types of ranges that merchants use as reference factors on worth and time charts. Let’s discover a few of these ranges:

- Horizontal Ranges: Horizontal traces on a chart symbolize worth ranges. Merchants typically establish important help and resistance ranges the place worth has traditionally reacted, reversed, or consolidated. These ranges act as psychological boundaries and may affect future worth actions.

- Vertical Ranges: Vertical traces symbolize time intervals on a chart. Merchants could use these traces to mark vital occasions, corresponding to financial releases, information bulletins, or particular buying and selling periods. Vertical ranges assist in understanding the timing and length of market actions.

- Diagonal Ranges: Diagonal traces, together with trendlines or channels, point out the change in worth over time. They replicate the velocity or slope of worth actions. Merchants use trendlines to establish the route of the market and potential entry or exit factors.

Different curved traces drawn by indicators or chart patterns may fall underneath the class of diagonal ranges. These traces seize the altering dynamics of worth actions. Why do these ranges work? One motive is that merchants typically purchase and promote in markets with the objective of creating income. Moreover, periodic (oscillatory) techniques inherently have a restricted vary of worth oscillations, which could be noticed within the markets. Furthermore, folks naturally wish to make plans, and constructing plans primarily based on identified knowledge is extra dependable. For instance, a easy but efficient buying and selling technique may contain shopping for an asset, holding it till its worth doubles, after which promoting it. Right here, the “pure” worth stage is 100%. Merchants might also contemplate defending their capital by putting stop-loss orders if the worth strikes in opposition to their expectations. Some merchants draw traces or bands on charts to mark the start and finish of tendencies, assuming that the worth will at the least attain midway towards the marked distance, given its preliminary motion. Merchants place their orders at these ranges to reduce dangers. They like taking half of the potential revenue reasonably than lacking out totally as a result of a sudden reversal. This pondering leads them to create a stage at 50%. Every new or apparent thought primarily based on frequent sense, supported by statistics and printed findings, supplies the premise for accumulating orders at particular zones. Usually, these zones could be calculated, permitting merchants to leverage the benefit offered by this information.

By understanding and using these several types of ranges, merchants can acquire invaluable insights and make knowledgeable buying and selling choices.

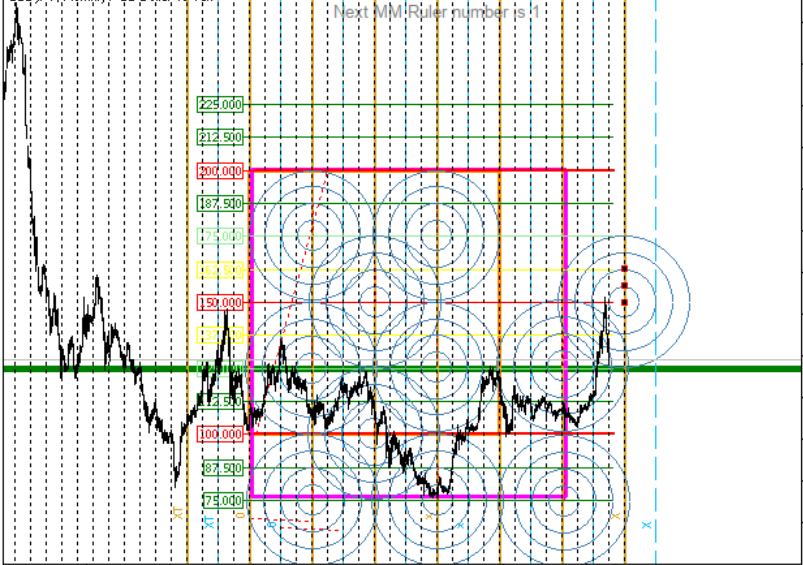

Within the picture you may see the velocity of figuring out the degrees to attend for its breakdown and enter the place.

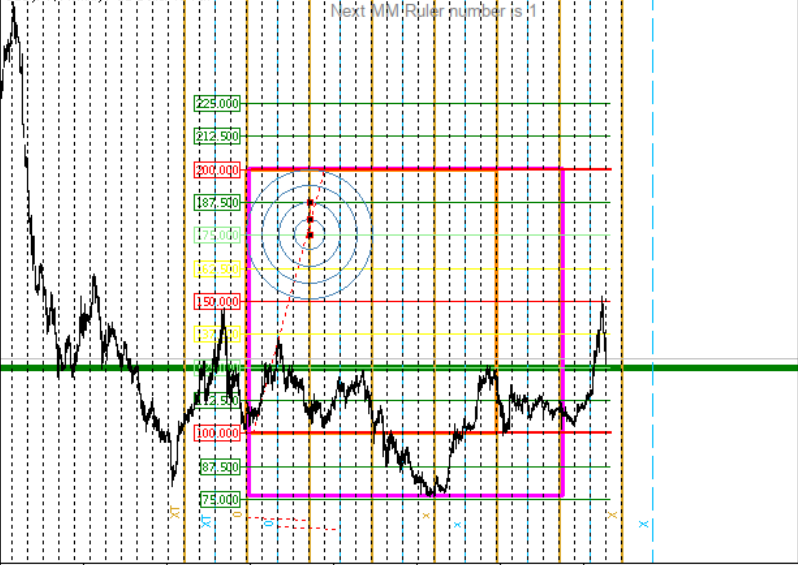

Battle Circles

Such phenomenon as “battle circles” or “circles of contradiction” seem at intersections of ranges 2/8, 4/8, 6/Eight vertically and horizontally. In MetaTrader, you may draw such circles utilizing the “Fibonacci Arcs”.

This set of objects possesses at the least one fascinating attribute: if the worth is transferring inside a variety, it is not going to enter the small, innermost circle, not to mention contact its heart. Nonetheless, if the worth is in an energetic trending motion, the inside circle is extra prone to be breached, and the worth will contact its heart. Following this, the worth could reverse into a chronic pattern in the wrong way, as seen in 2011, or proceed additional, as in 2007-2008. Nonetheless, when the worth approaches the boundary of this circle, this info turns into extremely important throughout all timeframes.

Sadly or luckily, I am unsure, however in MetaTrader, the dimensions of circles doesn’t alter when altering timeframes. Which means every timeframe requires its personal set of circles, and on the “Show” tab, it’s essential to disable the show of circles on all time ranges besides the present one.

On this technique, Murray Ranges have been utilized, which have confirmed to be extremely efficient in buying and selling. These ranges present invaluable insights into worth actions and can assist establish key help and resistance areas. By incorporating Murray Ranges into the buying and selling method, merchants could make extra knowledgeable choices and doubtlessly enhance their buying and selling outcomes.

Conclusion

The Murray system supplies merchants with a flexible toolkit for assessing the present worth place and making correct buying and selling choices. It’s not essential to make the most of each single device introduced right here, however limiting oneself to solely horizontal ranges appears totally misguided. Velocity traces (diagonals), time traces (verticals), and battle circles are highly effective predictive devices, and by incorporating them, merchants can considerably improve the accuracy of their trades, thereby growing income and decreasing losses. The development of those ranges could be simply formalized (apart from the development of arcs, the place discovering a scaling technique could also be required), and as soon as established, these ranges will work for a very long time, constantly offering exact entry alerts. Moreover, in my advisor, I’ve built-in a neural community, which has additional strengthened its capabilities. By combining the ability of the Murray system with the intelligence of a neural community, the advisor can present much more correct and dependable buying and selling alerts. The neural community analyzes huge quantities of knowledge and market tendencies in real-time, permitting the advisor to adapt to altering market situations and keep forward of the curve. With this enhanced performance, the advisor turns into a formidable device for merchants looking for to optimize their buying and selling methods and obtain constant profitability.