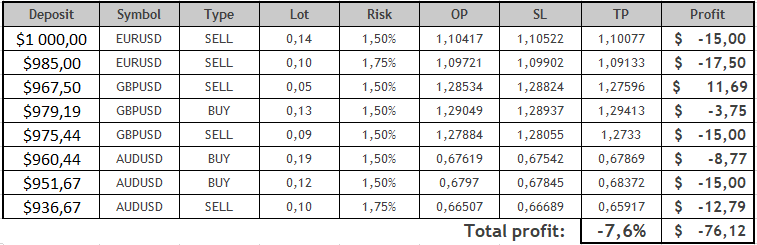

At the moment I current you an summary of trades made utilizing the Owl technique – good ranges for the EURUSD, GBPUSD and AUDUSD forex pairs for the week from July 24 to 28, 2023. There have been open in whole Eight trades on all three forex pairs.

For comfort and well timed receipt of alerts I exploit the Owl Good Ranges Indicator. The primary buying and selling timeframe is M15, whereas the H1 and H4 timeframes are used to verify the development route of the upper timeframe.

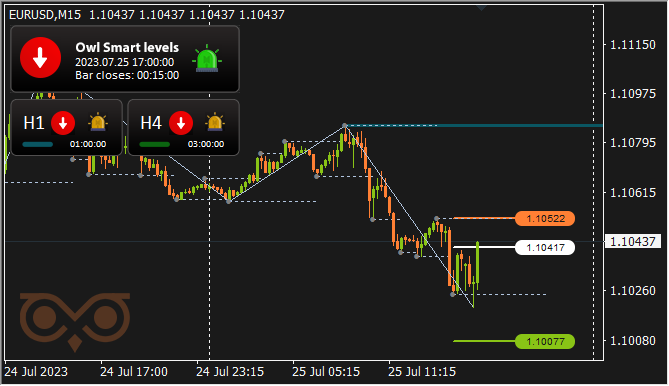

EURUSD evaluation

The Owl Good Ranges indicator gave the primary sign to open a commerce on EURUSD for promoting on Tuesday afternoon.

Fig. 1. EURUSD SELL 0.14, OpenPrice = 1.10417, StopLoss = 1.10522, TakeProfit = 1.10077, Revenue = -$15.

The commerce was closed at StopLoss and introduced a lack of $15.

The market spent the entire Wednesday and the primary half of Thursday within the useless zone, after which it spiked greater than 1000 factors in lower than 2 hours.It ought to be stated that on the whole the market behaved slightly unpredictably, however, what is particularly unhealthy, it was not so clearly seen, besides, maybe, for the above-mentioned peak.

However, the second commerce on EURUSD, additionally opened for promoting, turned out to be unprofitable.

Fig. 2. EURUSD SELL 0.10, OpenPrice = 1.09721, StopLoss = 1.09902, TakeProfit = 1.09133, Revenue = -$17.5.

The commerce closed on StopLoss and Owl Good Ranges, sadly, could not warn about it on account of uncommon market volatility.

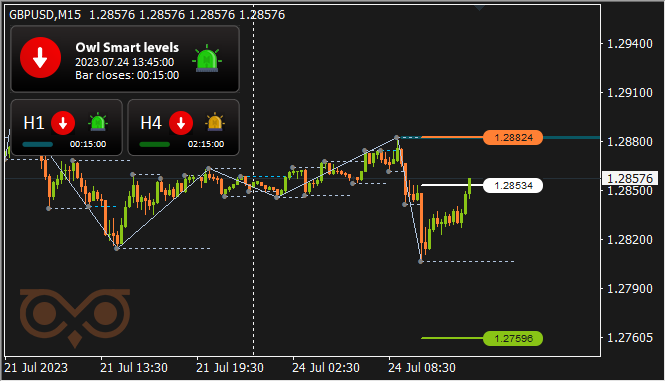

GBPUSD evaluation

The primary commerce on the asset GBPUSD the indicator Owl Good Ranges provided to open for promoting on Monday afternoon.

Fig. 3. GBPUSD SELL 0.05, OpenPrice = 1.28534, StopLoss = 1.28824, TakeProfit = 1.27596, Revenue = $11.69.

This commerce turned an instance of how the sign given in time in regards to the change of value motion and the need to shut it “manually” helped not solely to scale back the loss, but in addition to get a small revenue.

The indicator urged to open the subsequent commerce on Wednesday, additionally in the midst of the day.

Fig. 4. GBPUSD BUY 0.13, OpenPrice = 1.29049, StopLoss = 1.28937, TakeProfit = 1.29413, Revenue = -$3.75.

And on this case the loss was lowered to the very minimal, additionally by closing the commerce “manually” in keeping with the indicator’s prompting.

On Thursday within the afternoon the market was within the useless zone and the subsequent commerce, opened for promoting, occurred on Friday morning.

Fig. 5. GBPUSD SELL 0.09, OpenPrice = 1.27884, StopLoss = 1.28055, TakeProfit = 1.27330, Revenue = -$15.

It appears that evidently after the USD leap, in addition to after the EUR/USD market 1000 factors drop (the screenshot, because it appears by the point, reveals a parallel state of affairs), the pair forex restored its worth in a means that’s not fairly “clear” for the indicator, and in each instances it failed to present an accurate sign, in addition to to warn about closing the commerce.

On Friday afternoon the market was within the useless zone, and there have been no extra trades on the asset.

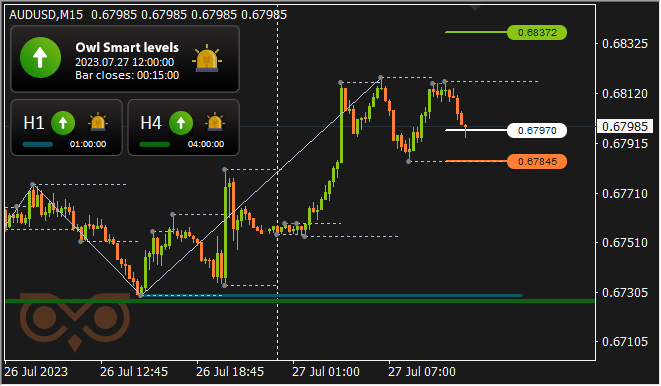

AUDUSD evaluation

On Monday within the afternoon the market was within the useless zone, and on Tuesday morning the indicator already gave a sign, and the commerce was opened.

Fig. 6. AUDUSD BUY 0.19, OpenPrice = 0.67619, StopLoss = 0.67542, TakeProfit = 0.67869, Revenue = -$8.77.

Right here the Owl Good Ranges gave a sign in time in regards to the necessity to shut the commerce and the loss was minimized.

However on the subsequent commerce it couldn’t be accomplished.

Fig. 7. AUDUSD BUY 0.12, OpenPrice = 0.67970, StopLoss = 0.67845, TakeProfit = 0.68372, Revenue = -$15.

There was no reversal of the large arrow and the commerce was closed at StopLoss.

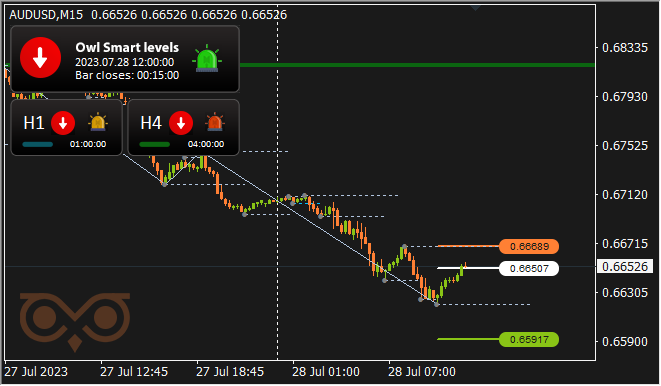

The final commerce of the buying and selling week was opened at midday on Friday.

Fig. 8. AUDUSD SELL 0.10, OpenPrice = 0.66507, StopLoss = 0.66689, TakeProfit = 0.65917, Revenue = -$12.79.

In addition to virtually all trades of the week, it turned out to be unprofitable, however right here the loss was barely minimized due to the Owl Good Ranges trace.

Outcomes:

Final buying and selling week there have been Eight trades and solely one among them turned out to be worthwhile. The trades have been opened in several instructions, however the market state of affairs this time, frankly to say, outplayed the Owl Good Ranges indicator on account of its, although not so pronounced, however excessive chaotic nature. Most certainly, the market chaoticization occurred because of the inconsistency with the forecasts of a lot of information, comparable to:

- German Manufacturing Enterprise Exercise Index (PMI) (EUR),

- UK Manufacturing Enterprise Exercise Index (PMI) (GBP),

- U.S. Providers Sector Enterprise Exercise Index (PMI) (USD),

- New House Gross sales (June) USA (USD),

- US Crude Oil Inventories (USD),

- German GDP (Q2) (EUR).

All of those information have been beneath the forecasts. And even when we aren’t speaking about some spectacular and excessive occasions and big volatility available in the market, however, the general impact of market chaotization was such that the Owl Good Ranges indicator didn’t have time to reply to such a quickly altering market.

In consequence, we bought an unsatisfactory outcome this week. To be truthful, for the reason that starting of this spring just one buying and selling week from Might 08 to 12 with the results of -45.86$ has been unprofitable to this point. The anti-record was crushed final week, however this type of market chaotic habits is kind of uncommon, and let’s hope it will not occur once more.

We are going to see how the buying and selling will seem like and the way the market will behave, which trades the Owl Good Ranges indicator will supply to open on Monday through the upcoming buying and selling week.

See different evaluations of the Owl Good Ranges technique:

I am Sergei Ermolov, observe me and do not miss extra helpful instruments for worthwhile buying and selling on Forex.