Yesterday’s constructive from sturdy US macro information was not sufficient for the greenback to have the ability to seriously change the scenario in its favor. Yesterday, the DXY greenback index rose to a 15-day excessive of 103.27, however then fell and is falling once more at present, dropping to 102.75 on the time of this text, in anticipation of the publication at present (at 12:30 GMT) of the US Division of Labor report with information for June: forecasts counsel that the US economic system was created +225.Zero thousand new jobs outdoors the agricultural sector (after +339.Zero thousand new jobs final month), and the unemployment fee fell by 0.1% to three.6% .

If official information from the US Division of Labor anticipated at present additionally seems to be weak, then the chance of a pause within the Fed’s financial tightening cycle will enhance once more.

In all probability, it might be acceptable for traders to concentrate to gold once more as a preferred defensive asset within the face of uncertainty and excessive inflation.

As you already know, gold quotes are very delicate to modifications within the financial coverage of the world’s largest central banks, primarily the Fed.

Subsequent Wednesday will likely be printed contemporary information on inflation within the US. Earlier experiences from the US Bureau of Labor Statistics pointed to a seamless slowdown in inflation. The Might report as soon as once more pointed to this: in Might, the annual CPI fell from 4.9% to 4.0% (forecasts assumed a rise of 4.1%). On the identical time, the core CPI (meals and vitality excluded from this indicator for a extra correct estimate) slowed to five.3% from 5.5% a month earlier.

If the July report additionally factors to a different slowdown in inflation within the US, it’s going to depart little doubt that the Fed will as soon as once more take a break from its assembly in July (July 25-26).

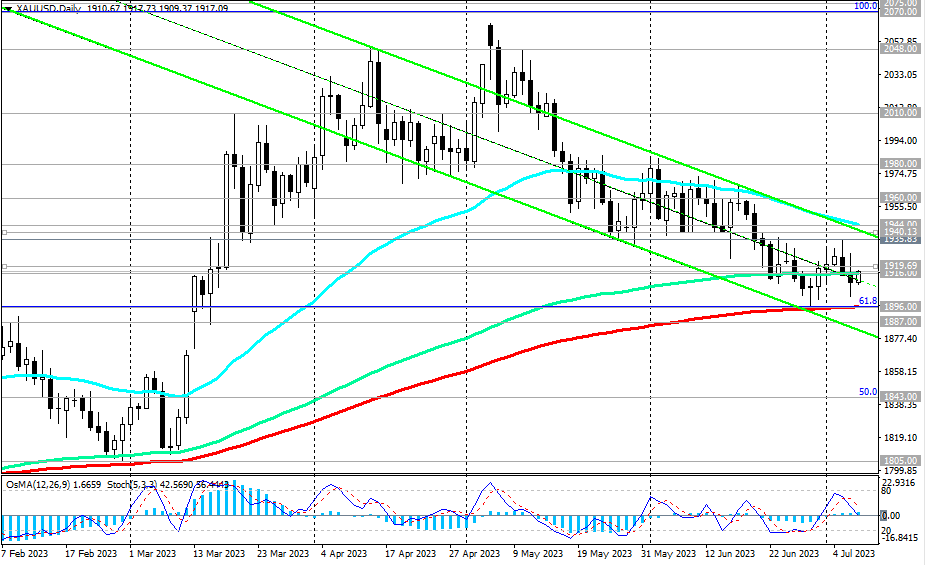

In flip, gold will then obtain one other argument in favor of the expansion of its quotes, particularly since now the XAU/USD pair is within the zone of key assist ranges of 1896.00, 1916.00, from which a rebound might happen and a brand new wave of progress might start.

The very first sign for resuming purchases of XAU/USD is a breakdown of the essential short-term resistance ranges of 1920.00 and 1928.00 (yesterday’s excessive).

The quickest sign for the implementation of another situation could also be a breakdown of the assist ranges of 1916.00, 1909.00 (at present’s minimal).

A break of 1875.00 will open the best way for a deeper decline in direction of the important thing long-term assist ranges at 1805.00, 1788.00, 1755.00, 1722.00, separating the long-term bullish development of gold from the bearish one.

Help ranges: 1916.00, 1909.00, 1900.00, 1896.00, 1887.00, 1843.00, 1805.00, 1788.00, 1755.00

Resistance ranges: 1919.00, 1927.00, 1936.00, 1940.00, 1944.00, 1960.00, 1980.00, 2000.00, 2010.00, 2048.00, 2070.00

*) extra particulars -> https://www.instaforex.com/forex_analysis/348157?x=PKEZZ