Immediately I current you an outline of trades made utilizing the Owl technique – sensible ranges for the EURUSD, GBPUSD and AUDUSD foreign money pairs for the week from August 21 to 25, 2023. The trades have been made in all property, however let’s speak about every part so as.

For comfort and well timed receipt of alerts I take advantage of the Owl Sensible Ranges Indicator. The principle buying and selling timeframe is M15, whereas the H1 and H4 timeframes are used to substantiate the development path of the upper timeframe.

EURUSD overview

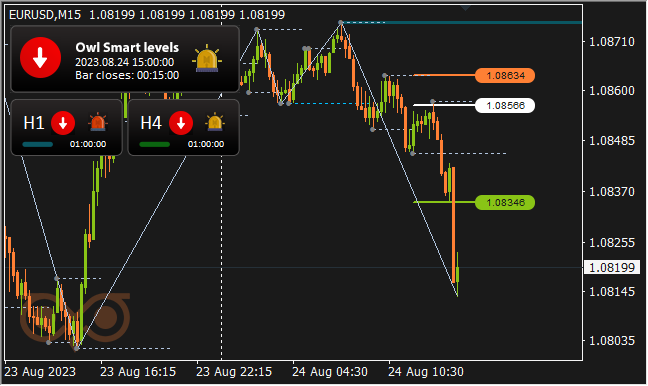

Virtually all Monday and the primary half of Tuesday the market was within the useless zone, and the primary sign to open a commerce on EURUSD for promoting was given by the Owl Sensible Ranges indicator on Thursday in the midst of the day.

Fig. 1. EURUSD SELL 0.22, OpenPrice = 1.08566, StopLoss = 1.08634, TakeProfit = 1.08346, Revenue = $48.53.

The commerce was closed at TakeProfit and introduced a revenue of 48$.

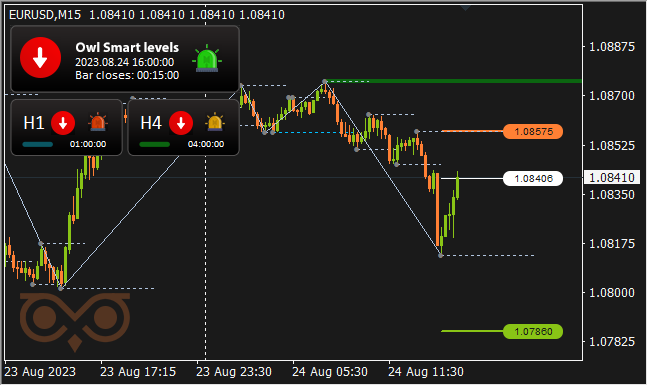

In the identical development, simply an hour later the second commerce was opened, additionally for promoting.

Fig. 2. EURUSD SELL 0.09, OpenPrice = 1.08406, StopLoss = 1.08575, TakeProfit = 1.07860, Revenue = $48.46.

The commerce turned out to be additionally worthwhile and introduced the a lot favourite by our indicator quantity of revenue of 48$.

GBPUSD overview

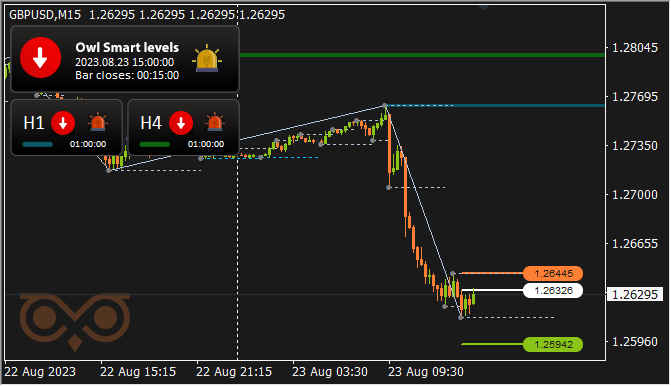

On the GBPUSD asset, the Owl Sensible Ranges indicator recommended opening a commerce for getting on Tuesday morning.

Fig. 3. GBPUSD BUY 0.15, OpenPrice = 1.27766, StopLoss = 1.27666, TakeProfit = 1.28090, Revenue = -$11.25.

The indicator gave a sign concerning the necessity to shut this commerce prematurely, and the losses of a number of {dollars} have been minimized.

The subsequent commerce opened on Wednesday afternoon was additionally unprofitable.

Fig. 4. GBPUSD SELL 0.13, OpenPrice = 1.26326, StopLoss = 1.26445, TakeProfit = 1.25942, Revenue = -$15.

The indicator warned by the flip of the large arrow on the final second, and the commerce was closed at StopLoss.

AUDUSD overview

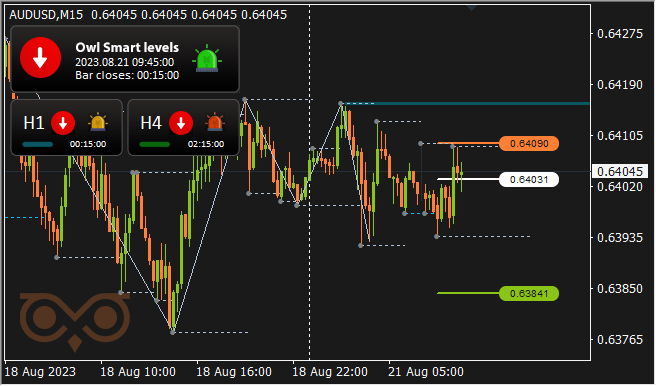

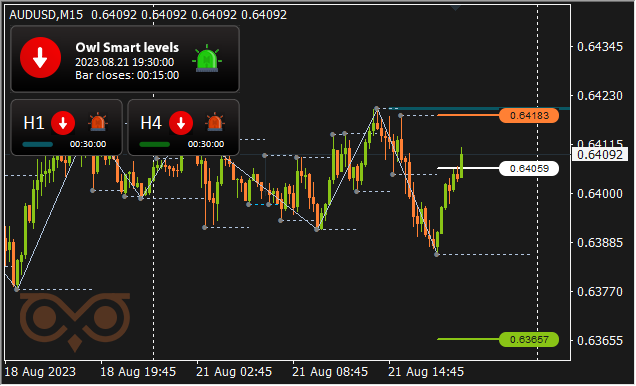

The Owl Sensible Ranges indicator signaled a possibility to open a commerce for promoting AUDUSD on Monday morning.

Fig. 5. AUDUSD SELL 0.25, OpenPrice = 0.64031, StopLoss = 0.64090, TakeProfit = 0.63841, Revenue = -$15.

The commerce was closed on StopLoss, because the indicator gave a warning by the reversal of the large arrow on the final candlestick earlier than this stage.

The identical might be attributed to the subsequent two trades. On Monday night another commerce was opened to promote the asset.

Fig. 6. AUDUSD SELL 0.14, OpenPrice = 0.64059, StopLoss = 0.64183, TakeProfit = 0.63657, Revenue = -$17.50.

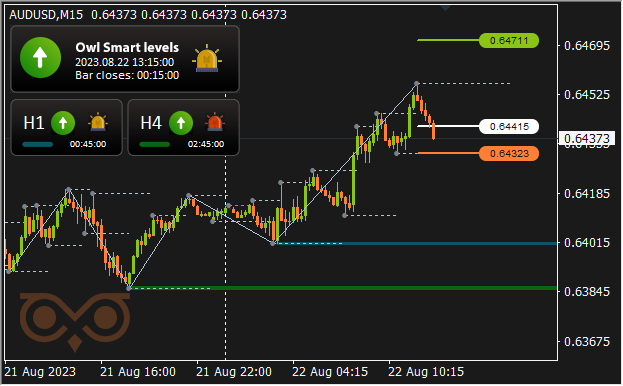

A commerce for getting was opened on Tuesday afternoon.

Fig. 7. AUDUSD BUY 0.22, OpenPrice = 0.64415, StopLoss = 0.64323, TakeProfit = 0.64711, Revenue = -$20.

Each trades have been unprofitable and closed at StopLoss, which was slightly higher than if we needed to shut them on the closing value of the candlestick on the reversal of the indicator’s large arrow, as a result of the sign was given slightly later than we might have preferred.

On Thursday the market spent many of the day and the entire day on Friday within the useless zone, and no extra trades have been opened on the asset.

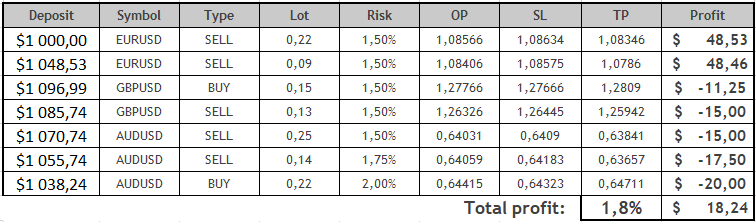

Outcomes:

So, 7 trades have been made over the last buying and selling week, the primary two of them have been worthwhile. The profitability of worthwhile trades exceeded the quantity of loss as typical, however 5 destructive trades significantly lowered the earnings from the primary two. That’s the reason the ultimate desk this time reveals a slightly modest optimistic end result.

We’ll see how the buying and selling will appear like and the way the market will behave, in addition to what trades Owl Sensible Ranges will supply us to open on Monday, in the course of the upcoming buying and selling week.

See different opinions of the Owl Sensible Ranges technique:

I am Sergei Ermolov, comply with me and do not miss extra helpful instruments for worthwhile buying and selling on Forex.