The temporary’s key findings are:

- In 2015, the variety of recipients of Social Safety incapacity insurance coverage (DI) started dropping quickly.

- A predictable cause was that an ageing inhabitants led extra recipients to maneuver onto retirement advantages.

- Extra surprisingly, although, the variety of new recipients additionally fell steeply.

- The outcomes recommend this drop was pushed by two components: 1) a powerful economic system; and a pair of) a stricter course of for awarding advantages on enchantment.

- With DI now in a stronger monetary place, it might be price considerably rebalancing its targets from encouraging work to defending the susceptible.

Introduction

In 2015, the variety of people receiving Social Safety Incapacity Insurance coverage (DI) advantages started to drop, reversing an upward development that had endured for 20 years. Policymakers have an interest within the extent to which this drop, which has considerably improved this system’s funds, displays a everlasting shift.1In 2015, when DI rolls have been at their peak, the Social Safety Trustees Report projected that the DI belief fund would deplete its reserves in 2016. In response, policymakers quickly reallocated a portion of the Social Safety payroll tax from the retirement program to the incapacity program. This infusion of income, mixed with the falling DI rolls, vastly improved the DI program’s monetary place. The 2023 Trustees Report projected that the fund would by no means deplete its reserves over the 75-year horizon (U.S. Social Safety Administration, 2015 and 2023a).

This current drop in DI rolls is because of elevated terminations, as beneficiaries age into Social Safety’s retirement program, mixed with a steep decline within the incidence fee (the variety of new DI awards relative to the insured inhabitants) beginning in 2010.

Three components could possibly be taking part in a task within the declining incidence fee. First, inhabitants ageing could have lowered the variety of DI functions as staff as a substitute claimed their retirement advantages. Second, a powerful economic system following the Nice Recession made DI much less engaging to potential candidates with some capacity to work. And third, coverage modifications on the U.S. Social Safety Administration (SSA) – particularly, discipline workplace closures and a complete retraining of Administrative Regulation Judges (ALJs) to scale back the speed of advantages awarded on enchantment – elevated the problem of making use of and lowered the share of candidates who have been accepted.

This temporary, which relies on a current examine, determines the relative contribution of every issue to the drop within the incidence fee from 2010-2019.2Liu and Quinby (2023). The dialogue proceeds as follows. The primary part gives background on the DI program. The second part highlights traits within the DI rolls over the previous 30 years. The third part describes the three components that might clarify the current decline within the incidence fee. The fourth part outlines the info and methodology for our evaluation, whereas the fifth part shows the outcomes. The ultimate part concludes {that a} sturdy economic system and the stricter ALJ appeals course of every account for about half of the overall drop within the incidence fee, whereas inhabitants ageing has had solely a modest impression.

Background

The DI program gives a primary degree of revenue to individuals who can’t work on account of incapacity or sickness.3For a superb introduction to the DI program, see Maestas, Mullen, and Strand (2021). In observe, nonetheless, the design of this system displays a pressure between twin targets: on the one hand, to guard susceptible individuals; and on the opposite, to encourage labor pressure participation for individuals who are capable of work.

Staff who apply for DI advantages face a prolonged software course of. First, an SSA discipline workplace checks that the employee has not engaged in Substantial Gainful Exercise (SGA) in the course of the previous 12 months.4In 2023, SGA is outlined as incomes greater than $1,470 per thirty days, growing to $2,460 for staff who’re blind. Subsequent, a medical expert at a state-administered Incapacity Willpower Providers workplace conducts a evaluate. The incapacity have to be anticipated to final for at the very least a 12 months and preclude the employee from performing any job within the nationwide economic system.5The evaluate considers age, schooling, and work historical past, however not geographic location. Staff who meet these standards are awarded DI advantages beginning on the sixth month after incapacity onset – with preliminary advantages enhanced to account retroactively for the applying interval – and are eligible for Medicare after a two-year ready interval. Staff who’re denied advantages can enchantment to an ALJ. If the ALJ nonetheless denies advantages, then the applicant can take their case to the Appeals Council, and even to federal court docket, however most don’t.

As soon as on the DI rolls, beneficiaries obtain a month-to-month profit equal to their Major Insurance coverage Quantity below Social Safety’s Previous-Age and Survivors Insurance coverage (OASI) program. Few beneficiaries ever return to work, regardless of insurance policies encouraging them to take action.6In 2019, lower than 1 p.c of DI beneficiaries left this system as a result of they returned to work (U.S. Social Safety Administration 2022b). As a substitute, they go away this system upon demise or at their Full Retirement Age after they robotically switch to the OASI program.

Traits in DI Rolls: 1990-2019

From 1990-2015, the variety of DI beneficiaries rose steadily on account of three components (see Determine 1). First, coverage reforms in 1984 expanded the definition of incapacity and gave candidates and medical suppliers extra affect over the choice course of. Second, incapacity charges enhance with age, and child boomers have been ageing into the extra lenient eligibility standards for advantages. Lastly, the rise in feminine labor pressure participation elevated the fraction of girls eligible for advantages, they usually too aged into the extra lenient standards. Albeit, on the similar time, a powerful labor market throughout a lot of this era put countervailing stress on the variety of new functions.7Liebman (2015) and Technical Panel on Assumptions and Strategies (2015). In recent times, although, the variety of beneficiaries has been declining.

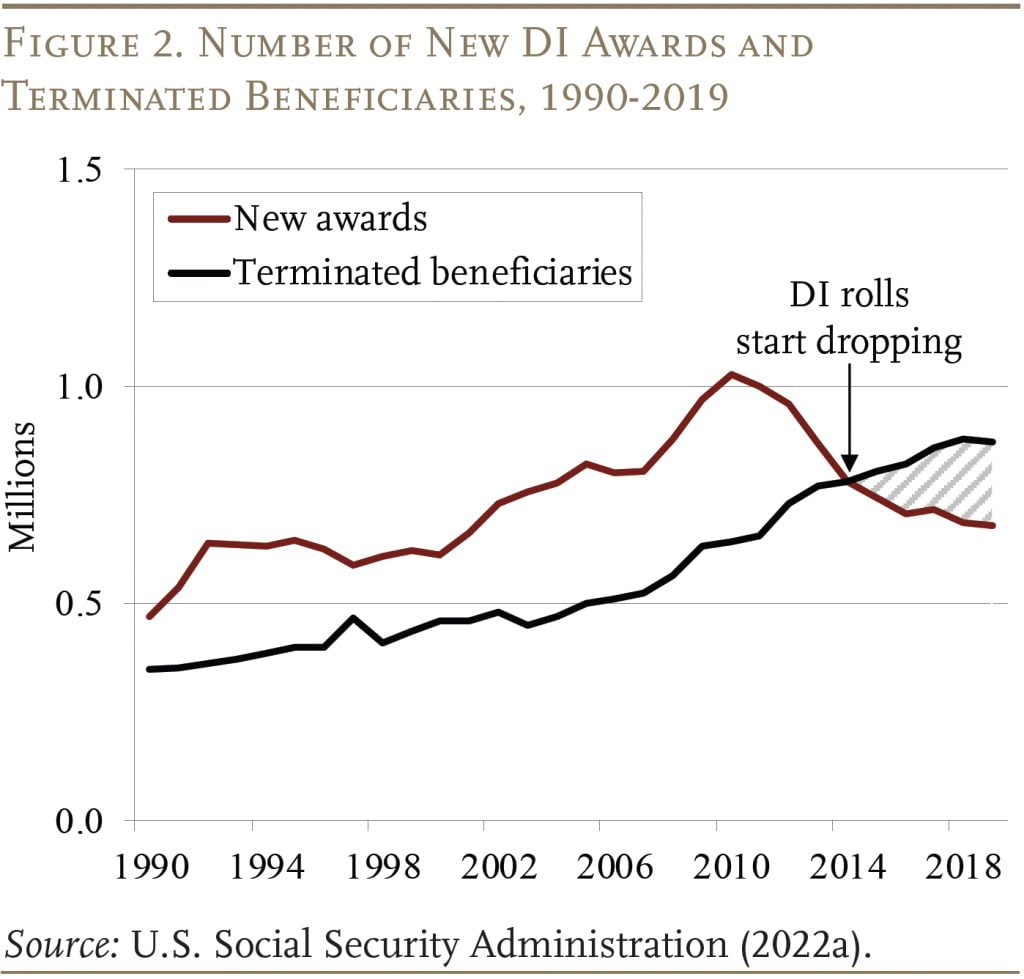

Earlier than 2015, the variety of new DI awards at all times exceeded the variety of beneficiaries leaving this system (see Determine 2). However the early 2000s noticed an acceleration of beneficiaries ageing into the OASI program. And, extra importantly, the variety of new DI awards has been dropping repeatedly since 2010. In 2015, the variety of new awards lastly fell under the variety of terminations so the DI rolls started to drop.

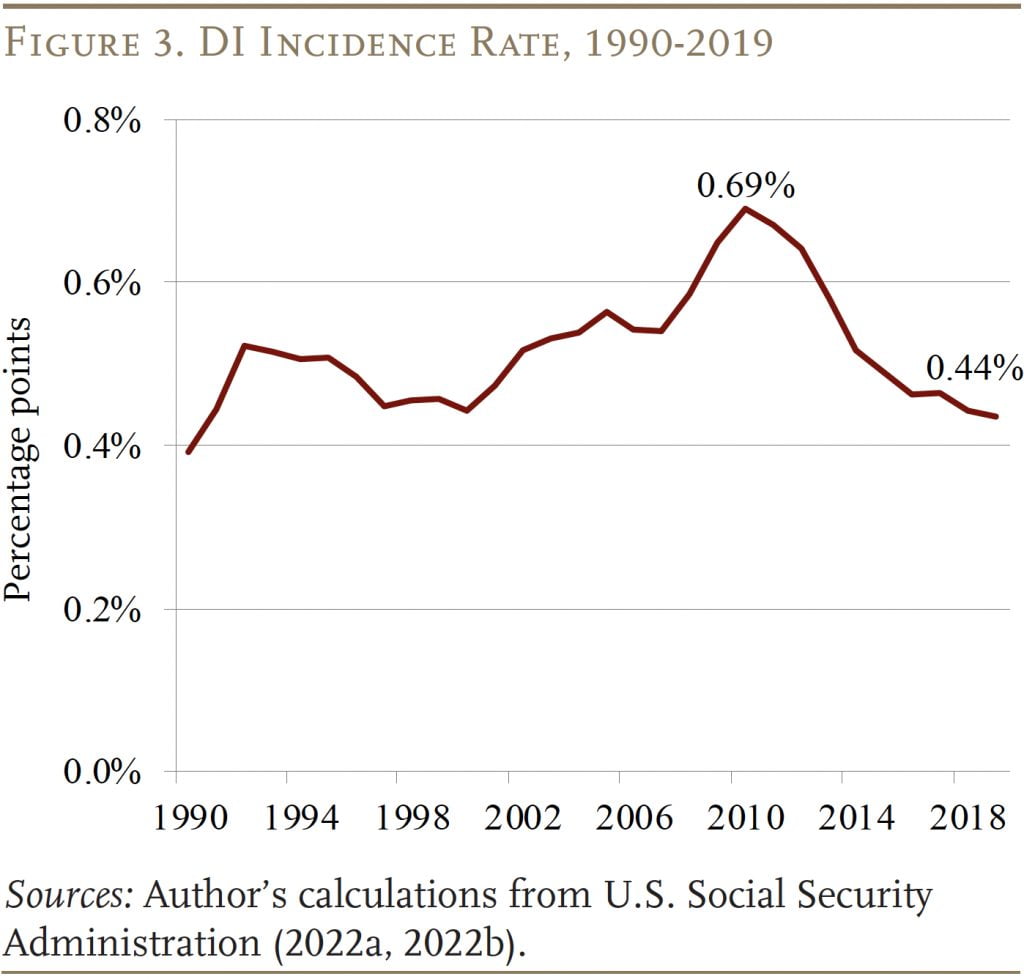

The decline in new awards isn’t on account of a contraction of the insured inhabitants, which really grew by virtually Three p.c from 2010-2019. As a substitute, it is because of a decline within the incidence fee, or the probability that eligible staff apply for and are awarded advantages (see Determine 3). By 2019, the incidence fee had dropped right down to 0.44 p.c from its 2010 peak of 0.69 p.c.

Though the incidence fee continued to say no in the course of the pandemic, financial situations, inhabitants well being, and the coverage setting additionally modified markedly when COVID hit. Most notably, SSA closed all its discipline workplaces for a interval of two years, coinciding with a pointy drop in DI functions. Since our aim is to grasp the structural forces driving down the DI rolls, moderately than the non permanent impacts of COVID, our evaluation stops earlier than the pandemic.8Early analysis on the pandemic interval consists of Goda et al. (2022 and 2023 forthcoming).

What Might Clarify the Declining Incidence Fee?

The steep decline within the incidence fee could possibly be on account of a number of components recognized in prior research.9See U.S. Social Safety Administration (2019) for a abstract of those potential explanations. These components could be grouped into three classes:

Inhabitants Getting old. The retirement of the newborn boomers is accelerating the speed at which DI beneficiaries go away this system, main some to invest that it may also be affecting the variety of new candidates. Really, a fast take a look at SSA’s administrative information means that inhabitants ageing remains to be placing upward stress on the incidence fee. Utility charges for DI enhance with age, and the typical age of the inhabitants focused by DI remains to be rising.10We calculate the age gradient in DI software charges and common age of candidates utilizing information on the variety of functions by age supplied by the SSA’s Workplace of Incapacity Packages, and counts of the inhabitants goal by DI by age from the Present Inhabitants Survey. An older applicant pool additionally implies the next allowance fee for advantages, given the extra lenient eligibility standards.11Nevertheless an older applicant pool will even enhance terminations in future years. Finally, inhabitants ageing could also be affecting the DI rolls by means of two channels that work in reverse instructions: extra recipients leaving this system and upward stress on the incidence fee. The query is, which channel dominated from 2010-2019?

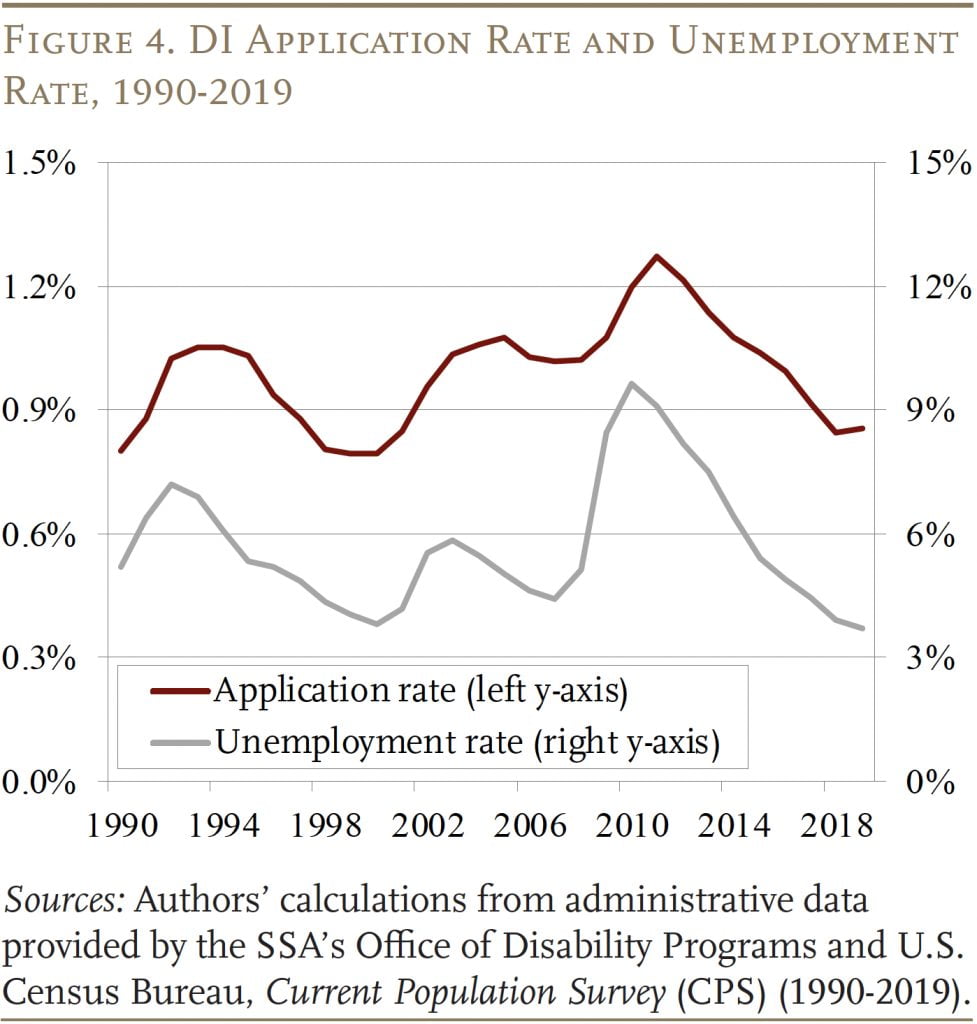

Enterprise Cycle. Since many staff with disabilities retain some work capability, the DI software course of turned much less engaging when the labor market improved after the Nice Recession.12A robust economic system additionally shifts the applicant pool towards these with extra extreme well being situations, elevating the allowance fee (Cutler, Meara, and Richards-Shubik 2012; Liebman 2015; Maestas 2019; and Maestas, Mullen, and Strand 2021). Certainly, analysts have lengthy famous that DI functions rise and fall with the unemployment fee (see Determine 4).13Stapleton et al. (1988); Cutler, Meara, and Richards-Shubik (2012); Liebman (2015); Maestas, Mullen and Strand (2015); and Maestas, Mullen, and Strand (2021).

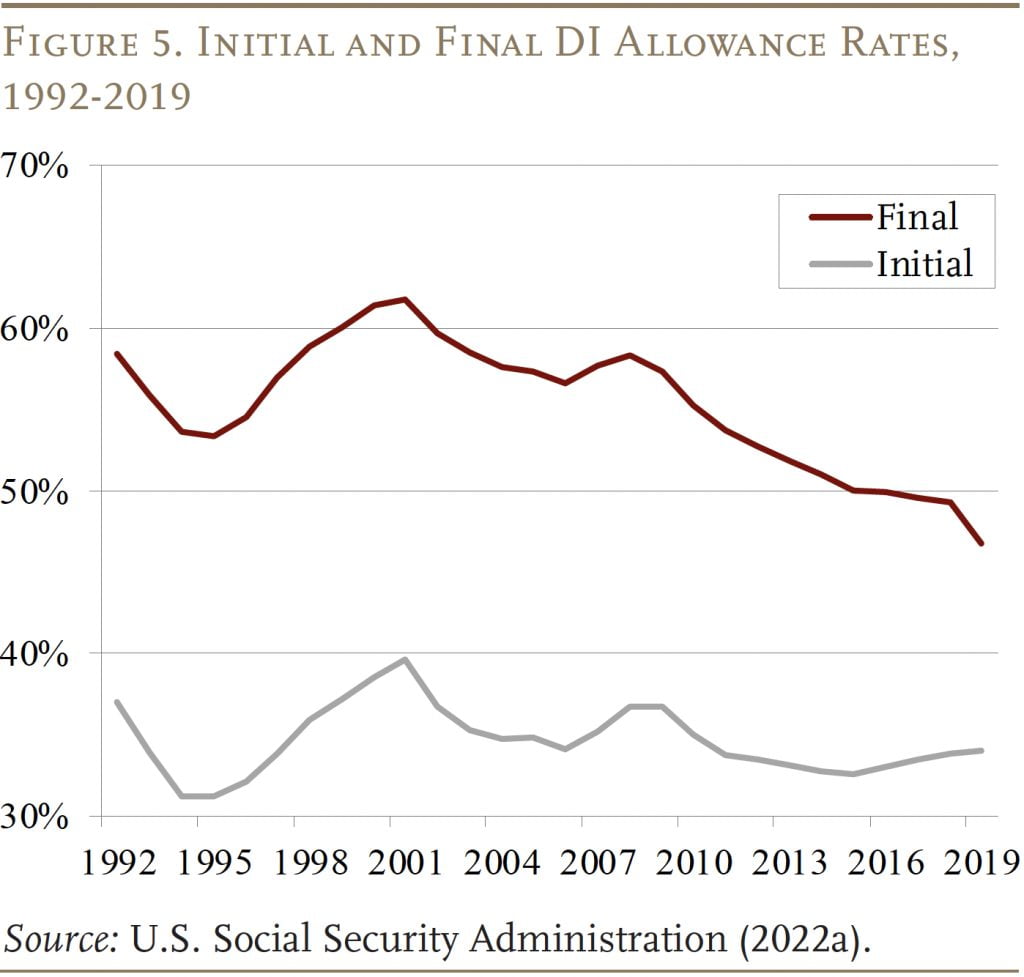

Coverage Change. The SSA made two notable modifications to the DI program that might have lowered each the variety of functions and the approval fee. First, on account of finances pressures, the company closed about 7 p.c of its discipline workplaces between 2001 and 2013. Since discipline workplaces are an vital supply of help, the closures elevated the price of making use of and lowered DI functions.14Deshpande and Li (2019). Moreover, in 2010 the SSA undertook a complete retraining of ALJs to enhance consistency of their decision-making and cut back appellate approval charges, resulting in a decline within the general allowance fee (see Determine 5).

Information and Methodology

We decompose the drop within the incidence fee by taking the extent change in every issue of curiosity (such because the unemployment fee or variety of discipline workplaces) and multiplying that change by the impression of every issue on awards. This strategy proceeds in three levels.15See Liu and Quinby (2023) for an in depth description of the info and methodology.

The primary stage accounts for inhabitants ageing. It begins by calculating age-specific incidence charges in 2010 utilizing SSA administrative information. These charges are then multiplied by the share of the insured inhabitants in every age group in subsequent years and averaged collectively.16We use the Present Inhabitants Survey to estimate the insured inhabitants, outlined right here as individuals ages 18-64 who will not be but receiving Social Safety advantages. This train yields the counterfactual incidence fee if all of the components, besides ageing, had remained at their 2010 ranges.17The counterfactual incidence fee is equal to the age-adjusted incidence fee in U.S. Social Safety Administration (2023b).

The second stage accounts for the enterprise cycle. SSA supplied administrative information on DI functions, by state and 12 months, for 1990-2019. We mix these data with insured inhabitants counts and unemployment charges – by state and 12 months – from the 1990-2019 Present Inhabitants Survey. Regression evaluation is then used to estimate how a 1-percentage-point change within the unemployment fee impacts the DI software fee. We multiply this regression consequence by the overall decline in unemployment skilled nationally between 2010 and 2019. The ensuing drop in DI functions is then multiplied by an allowance fee to point out how falling unemployment affected the DI incidence fee.

The third stage accounts for SSA coverage modifications. To start, we give attention to discipline workplaces as a result of a earlier examine has already established the consequences of closures on DI functions and awards within the native space.18Deshpande and Li (2019). Scaling this native estimate to the nationwide degree includes multiplying the marginal impression of 1 closure by the overall variety of closures and adjusting for the share of the inhabitants residing in affected areas.

The ultimate coverage is ALJ retraining. Since we lack convincing proof on the impression of this coverage on DI awards, we assume that any remaining distinction between the precise noticed incidence fee and the counterfactual incidence fee is the impact of ALJ retraining.19Whereas this strategy has the benefit of simplicity, it overstates the significance of ALJs if different components not thought-about listed here are additionally driving down the incidence fee.

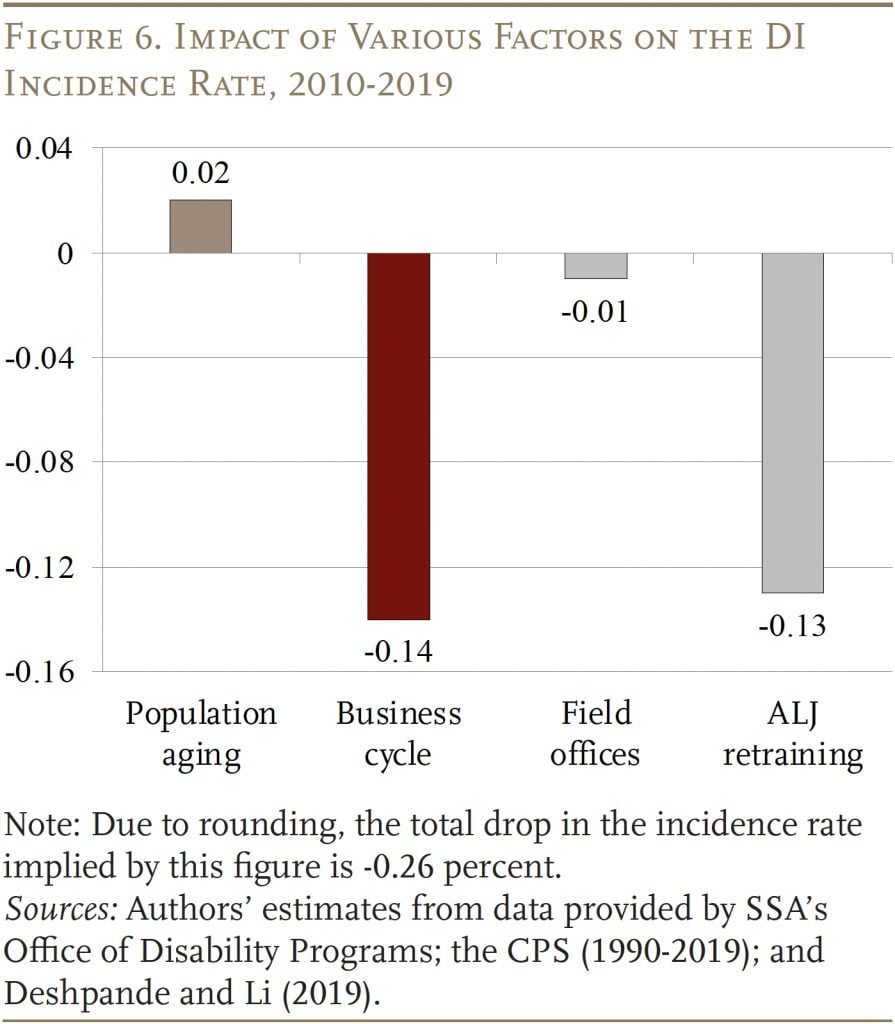

Determine 6 presents the primary discovering: how a lot of the 0.25-percentage-point drop within the incidence fee is attributable to the assorted components. The gold bar reveals that, between 2010 and 2019, inhabitants ageing would have elevated the incidence fee by 0.02 share factors if all the opposite components had stayed fixed. The purple bar reveals the impression of the enterprise cycle, which decreased the incidence fee by 0.14 share factors. The primary grey bar incorporates discipline workplace closures, reducing the speed by a slight 0.01 share factors.20The impact of discipline workplace closures is small as a result of they solely affected about Three p.c of the inhabitants throughout our evaluation interval. Lastly, ALJ retraining lowered the incidence fee by one other 0.13 share factors. Finally, the enterprise cycle and ALJ retraining emerge as the 2 most vital components driving down the incidence fee in recent times.21Our result’s according to Technical Panel on Assumption and Strategies (2019)’s discovering that the enhancing economic system and reducing allowance charges each contribute to the decline in incidence fee. Though the precise numbers are considerably delicate to the underlying modelling assumptions, the conclusion holds for an affordable vary of parameters. See Liu and Quinby (2023) for robustness checks.

Conclusion

Between 2015 and 2019, the DI rolls dropped steadily pushed by elevated terminations and a steep decline within the incidence fee. The falling incidence fee was attributable to a powerful economic system and fewer profit approvals by the ALJs. Whereas inhabitants ageing is at the moment placing slight upward stress on the incidence fee, it additionally drives the current progress in terminations, pushing down the DI rolls general. With the funds of DI now on a stronger trajectory, the time could have come to considerably rebalance the targets of DI from encouraging labor pressure participation to defending susceptible individuals.

References

Cutler, David M., Ellen Meara, and Seth Richards-Shubik. 2012. “Unemployment and Incapacity: Proof from the Nice Recession.” Working Paper NB 12-12. Cambridge, MA: Nationwide Bureau of Financial Analysis.

Deshpande, Manasi and Yue Li. 2019. “Who’s Screened Out? Utility Prices and the Concentrating on of Incapacity Packages.” American Financial Journal: Financial Coverage 11(4): 213-248.

Goda, Gopi Shah, Emilie Jackson, Lauren Hersch Nicholas, and Sarah See Stith. 2022. “The Impression of Covid-19 on Older Staff’ Employment and Social Safety Spillovers.” Journal of Inhabitants Economics 36: 813-846.

Goda, Gopi Shah, Emilie Jackson, Lauren Hersch Nicholas, and Sarah See Stith. 2023 (forthcoming). “Older Staff’ Employment and Social Safety Spillovers Via the Second Yr of the Covid-19 Pandemic.” Journal of Pension Economics and Finance.

Liebman, Jeffrey B. 2015. “Understanding the Improve in Incapacity Insurance coverage Profit Receipt in the USA.” Journal of Financial Views 29(2): 123-150.

Liu, Siyan and Laura D. Quinby. 2023. “What Elements Clarify the Drop in Incapacity Insurance coverage Rolls from 2015 to 2019?” Working Paper 2023-7. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

Maestas, Nicole. 2019. “Figuring out Work Capability and Selling Work: A Technique for Modernizing the SSDI Program.” The Annals of the American Academy of Political and Social Science 686(1): 93-120.

Maestas, Nicole, Kathleen J. Mullen, and Alexander Strand. 2015. “Incapacity Insurance coverage and the Nice Recession.” American Financial Evaluation: Papers and Proceedings 105(5): 177-182.

Maestas, Nicole, Kathleen Mullen, and Alexander Strand. 2021. “The Impact of Financial Situations on the Incapacity Insurance coverage Program: Proof from the Nice Recession.” Journal of Public Economics 199: 1-22.

Stapleton, David, Kevin Coleman, Kimberly Dietrich, and Gina Livermore. 1988. “Empirical Analyses of DI and SSI Utility and Award Progress.” In Progress in Incapacity Advantages: Explanations and Coverage Implications, edited by Kalman Rupp and David Stapleton, 31-92. Kalamazoo, Michigan: W.E. Upjohn Institute for Employment Analysis.

Technical Panel on Assumptions and Strategies. 2019. “Report back to the Social Safety Advisory Board.” Washington, DC.

Technical Panel on Assumptions and Strategies. 2015. “Report back to the Social Safety Advisory Board.” Washington, DC.

U.S. Social Safety Administration. 2023a. Annual Report of the Board of Trustees of the Federal Previous-Age and Survivors Insurance coverage and Federal Incapacity Insurance coverage Belief Funds. Washington, DC.

U.S. Social Safety Administration, Workplace of the Chief Actuary. 2023b. “The Lengthy-Vary Incapacity Assumptions for the 2023 Trustees Report.” Washington, DC.

U.S. Social Safety Administration. 2022a. Annual Statistical Report on the Social Safety Incapacity Insurance coverage Program. Washington, DC.

U.S. Social Safety Administration. 2022b. Annual Statistical Complement to the Social Safety Bulletin, 2022. Washington, DC.

U.S. Social Safety Administration, Workplace of Retirement and Incapacity Coverage. 2019. “Traits in Social Safety Incapacity Insurance coverage.” Briefing Paper No. 2019-01. Washington, DC.

U.S. Social Safety Administration. 2015. Annual Report of the Board of Trustees of the Federal Previous-Age and Survivors Insurance coverage and Federal Incapacity Insurance coverage Belief Funds. Washington, DC.

U.S. Census Bureau. Present Inhabitants Survey, 1990-2019. Washington, DC.