At this time I’ll present you some trades made by the Prop Grasp Professional Advisor.

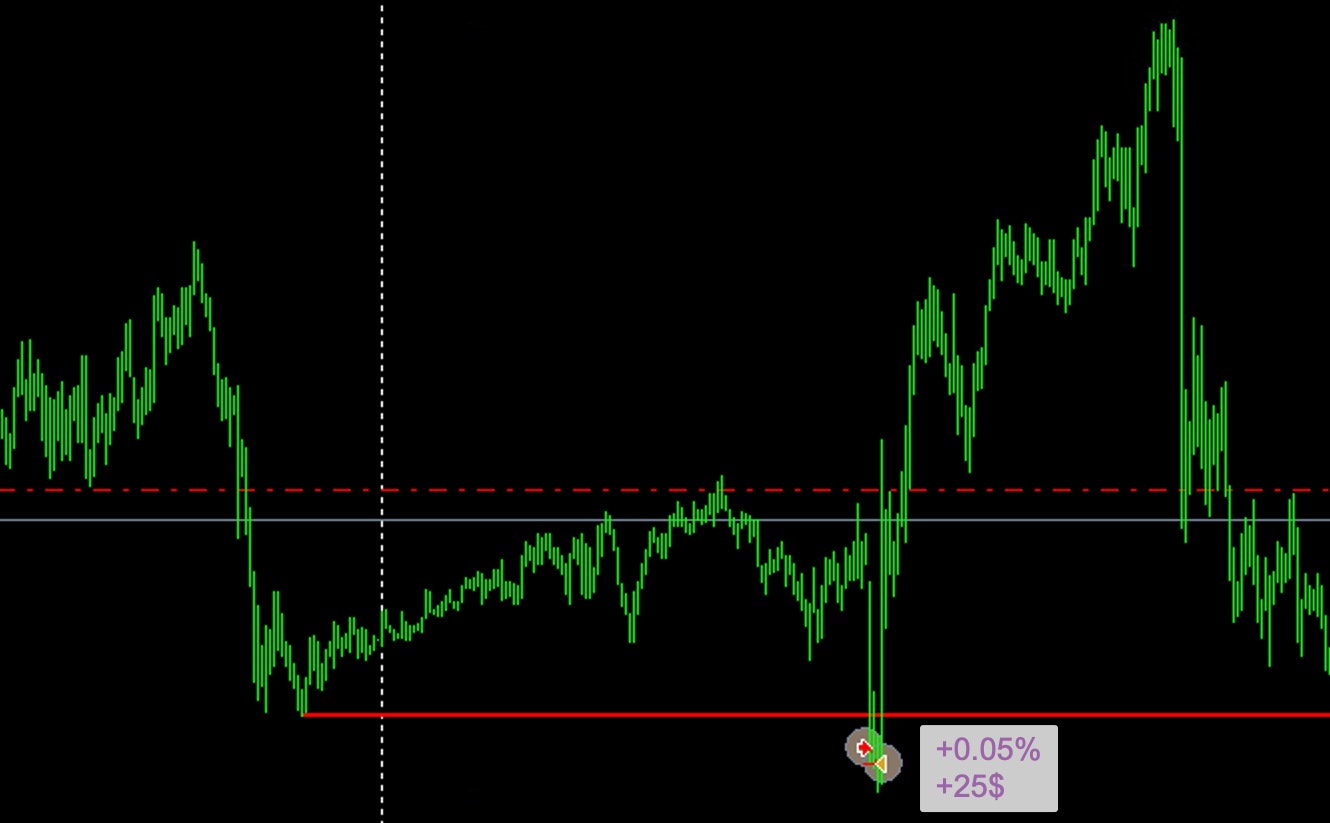

1. EURUSD on Could 14, 2024. The utmost value worth of the day before today was damaged and the market reached TakeProfit in a short time.

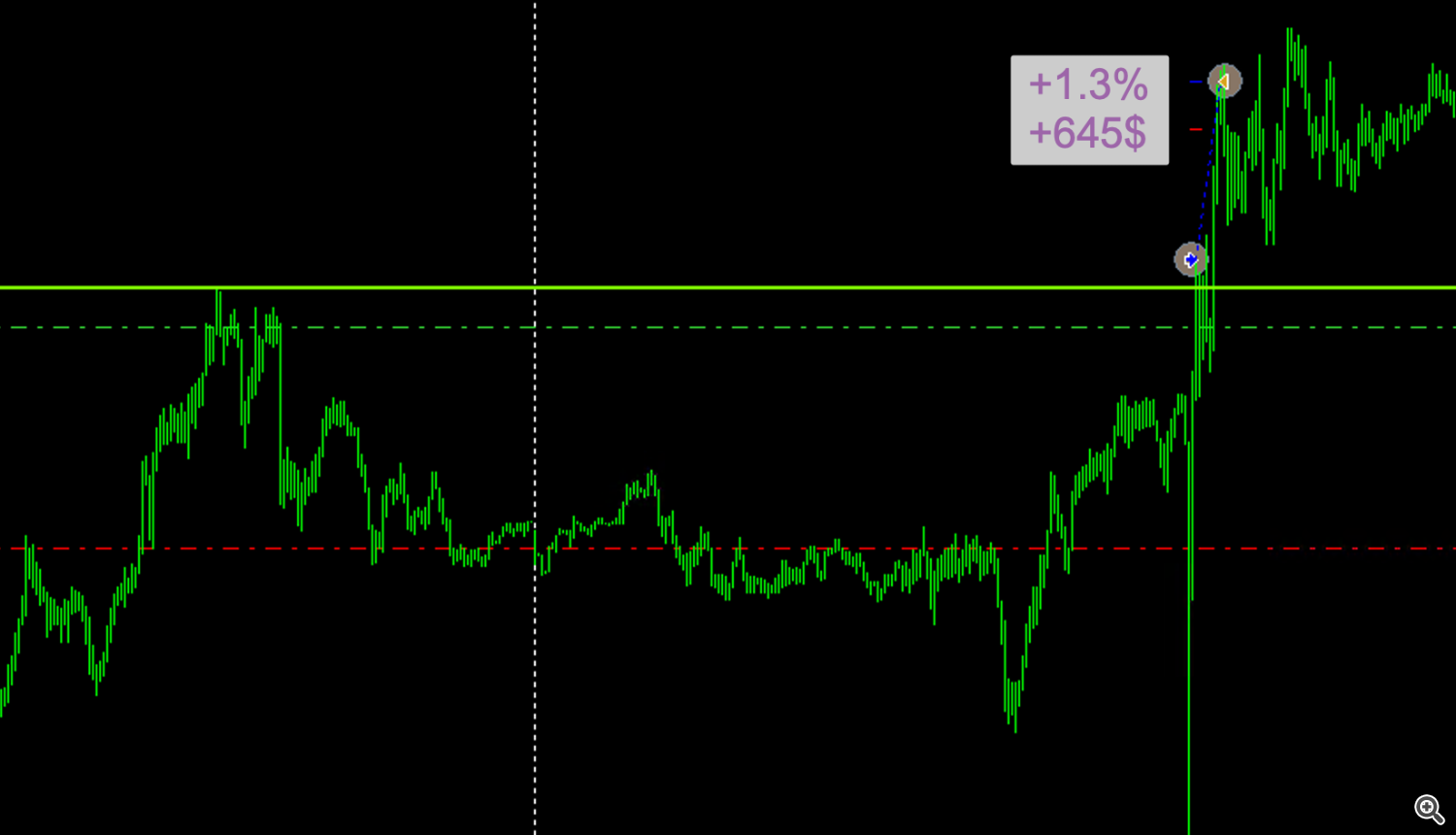

2. EURUSD Could 17, 2024. The commerce closed at trailing-stop. On this case, evidently the trailing cease prevented us from incomes extra. If we have a look at the particular commerce, it appears like this. If we have a look at the general statistics, typically trailing cease helps to earn not less than some revenue, in these instances when the value turns round earlier than reaching TakeProfit.

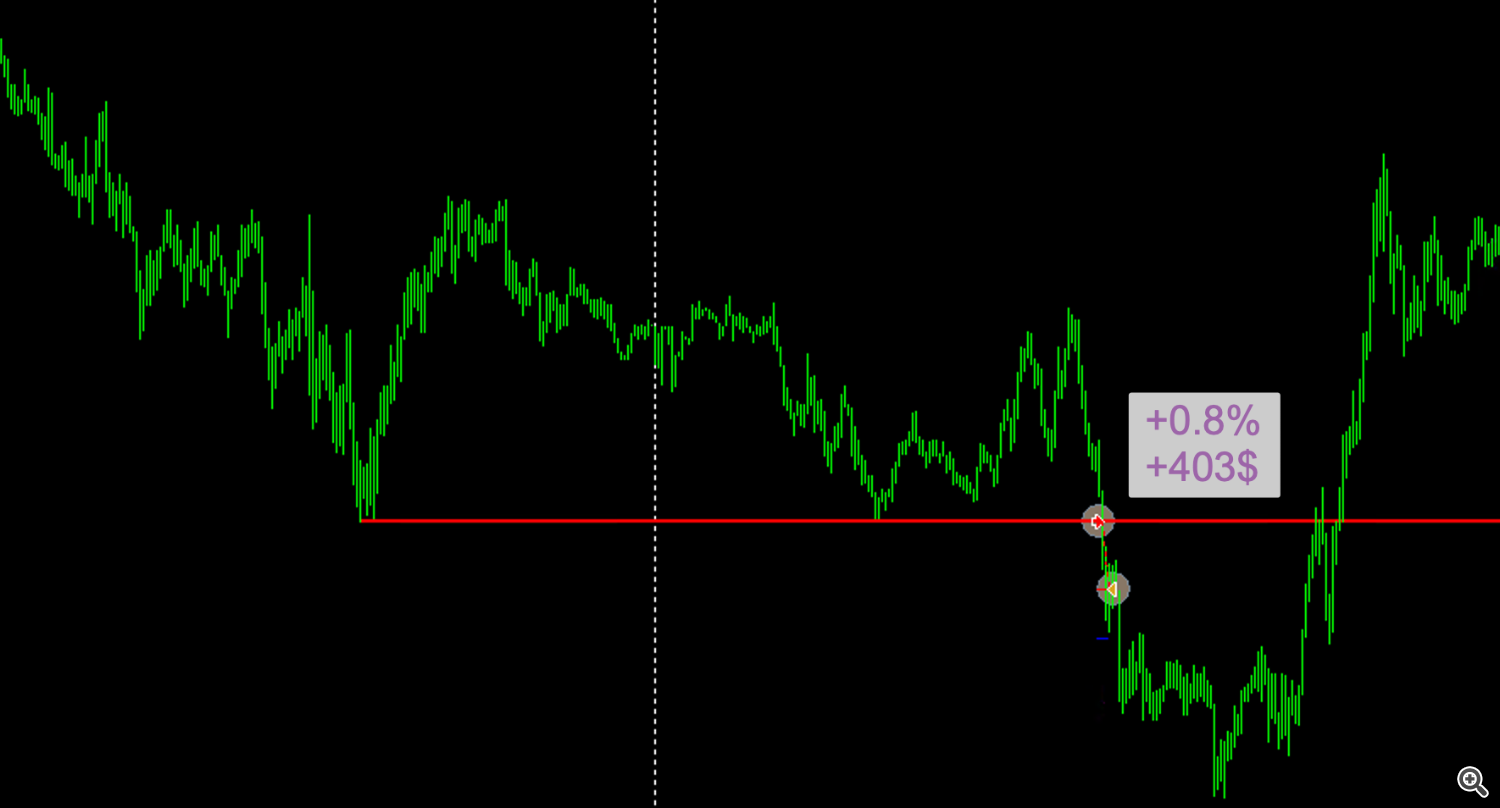

3. EURUSD Could 23, 2024. An instance of a commerce when trailling-stop perform permits to keep away from a loss in the mean time of false breakout of the assist stage. You may see how a breakout of the value stage happens after which a pointy value motion in the other way. Trailing cease on this case not solely allowed to keep away from a loss, but in addition allowed to earn a small revenue. This is the reason utilizing a trailing cease is necessary whenever you commerce utilizing a value stage breakout technique to maximise earnings and keep away from losses on a reversal of the value in the other way.