Listed below are some ceaselessly requested questions from clients, that are being constantly up to date.

Why is the Cease loss set so giant?

As a result of after we designed the EA, we primarily relied on strategy-based closing of positions reasonably than cease losses. The cease loss is ready very extensive to scale back the potential for it being triggered. The present level ranges can maximize income in long-term buying and selling. When market situations are favorable, the cease loss will not often be triggered.

Can the EA deal with XAUUSD buying and selling?

The patterns of gold buying and selling are considerably completely different from foreign exchange, so this EA can’t be utilized to gold buying and selling. We use one other EA particularly for buying and selling gold.

Why does it carry out so nicely in backtests?

The EA makes use of deep studying expertise and is educated on historic market knowledge, which is why it performs higher in backtests. For future market situations, the EA wants to make use of the patterns it has discovered to make predictions, however information occasions and different components might quickly alter market patterns. Nevertheless, such conditions will not be too frequent. Because of this, our stay accounts at the moment obtain about 70% of the backtest efficiency. That is already a fairly spectacular outcome. There is not any want to fret an excessive amount of. When utilizing the identical model, backtest and stay efficiency are constant. The essential precept in our EA design is security. So long as you do not use excessively excessive danger values, it ought to be nice.

Moreover, we typically replace the most recent coaching knowledge throughout updates, together with changes to methods and parameters. This example might also change the backtest efficiency. So after we point out consistency between stay buying and selling and backtesting, it typically refers back to the premise of utilizing the identical model

What imply the brand new enter “random worth offset vary (under 5)” within the enter tab?!

Some clients use our EA on prop problem accounts. They require their orders to be as completely different as potential from others. Now we have added this characteristic for that objective. It can delay the EA’s opening place by a random variety of factors inside 5. Too giant quite a lot of factors would have an effect on the EA’s efficiency. In case you do not want this characteristic, you’ll be able to set it to 0.

Is it potential to alter my knowledgeable advisor from MT5 to MT4? Thanks

It is not potential to alter. You possibly can solely use the model for the platform you bought. We won’t modify it both. Nevertheless, if you really want it, we will offer you an extra sure model.

You do not assume if the EA predicted the market was going a method however then as a consequence of information, it reversed, a information filter may work for even a swing buying and selling system to intervene and cease or alter the trades?

People can analyze information and analysis data. For EAs, that is troublesome, and even probably the most clever AI fashions at the moment accessible are less than the duty. The widespread method now’s filtering, achieved earlier than information releases, however that is solely potential for high-frequency EAs, which generally do not maintain positions for greater than a day. Nevertheless, that is additionally a weak point of their technique, because the revenue factors are too few, they often use high-leverage methods. When surprising information happens, they cannot predict or filter upfront, and in extreme circumstances, it may possibly lead on to a margin name. In distinction, our technique includes giant fluctuations with small leverage, so even the impression of surprising information is just not deadly. We consider that is the way in which to actually survive on this market. Each technique has its execs and cons. That is our expertise from over a decade within the foreign exchange market.

Presently, the EA doesn’t have a information filter. We consider that the impression of reports on the EA has an equal likelihood of being constructive or detrimental, and swing buying and selling methods will not be efficient in filtering or capitalizing on news-driven market actions. To maximise income, the EA maintains long-term positions. In case you are involved concerning the impression of reports, you’ll be able to strive guide intervention. You should use the “purchase solely” or “promote solely” capabilities within the settings to regulate the EA’s buying and selling route.

Is that this EA appropriate for various brokers?

Completely different brokers might have slight variations as a consequence of variations in market knowledge. We have noticed comparable discrepancies with the 2 brokers we use, EXNESS and IC Markets, for this explicit commerce. Nevertheless, by way of long-term buying and selling statistics, we have discovered that these variations will not be vital, so there is not any want to fret an excessive amount of.

Is it potential so as to add a break-even perform or cut back the trailing cease loss worth?

Now we have thought-about this characteristic, and it is comparable in precept to Take Revenue (TP). Nevertheless, setting too small a revenue goal would result in drawdowns exceeding income, thereby decreasing total income. We should not focus solely on just a few orders or a brief market development. Our parameters, for the sake of long-term market steadiness, need to forgo some small revenue alternatives. It’s because when the route is right, small income can develop into massive income, a conclusion drawn from massive knowledge evaluation.

May you please clarify intimately the desynchronization situation you talked about?

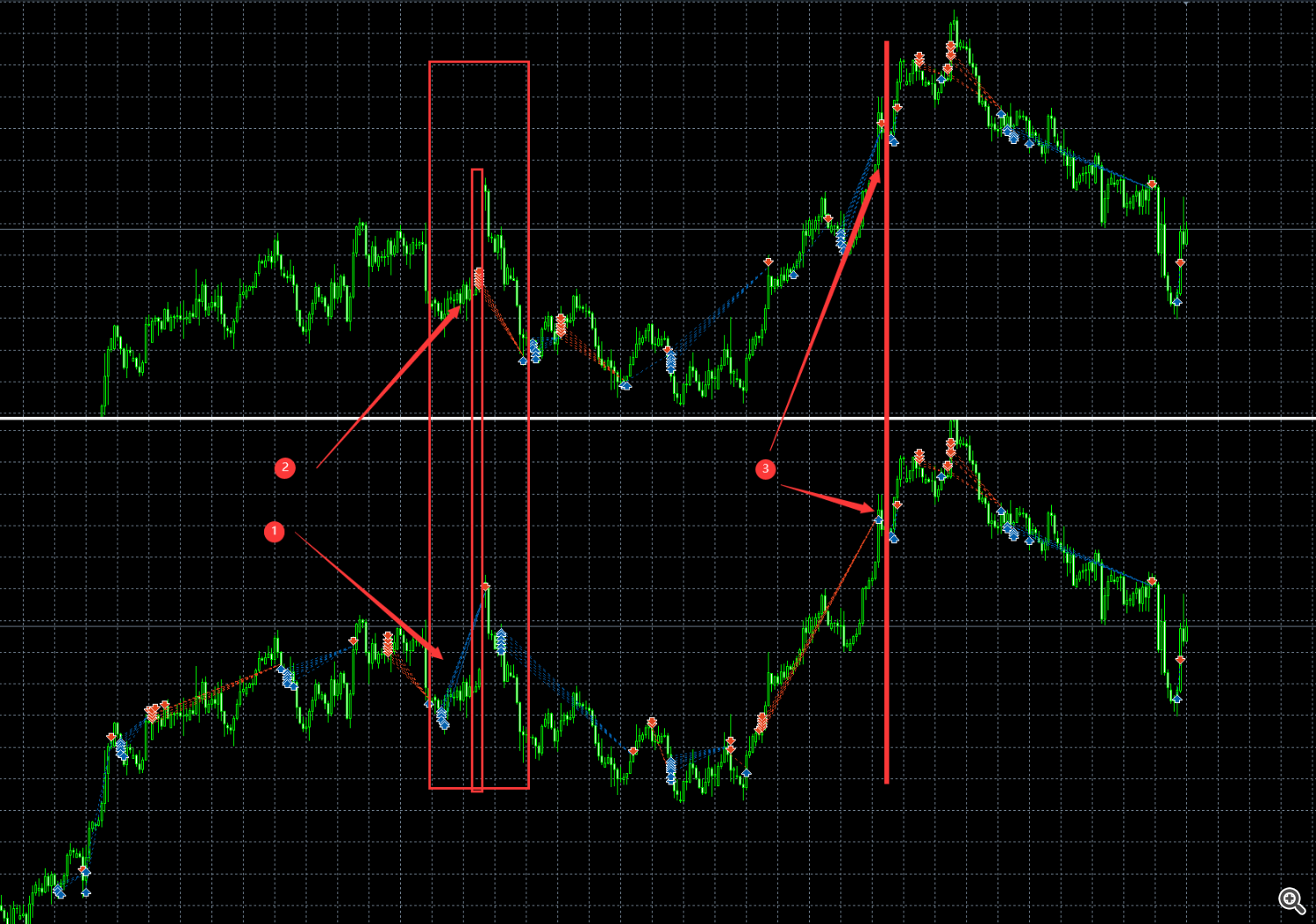

As proven within the determine under, when beginning to use the EA at completely different instances, there will probably be current orders as proven in 1, whereas order 2 is a brand new entry level decided by the EA based mostly on the most recent market situation when it has no open positions. As a result of distinction in these orders, many subsequent orders can even be affected. It is not till order 3, when each buying and selling accounts are concurrently with out open positions, that the following orders develop into synchronized.

How can we synchronize the stay account with the backtest?

Generally the backtest could also be half a day to a day slower than stay buying and selling. We advocate utilizing the minimal lot dimension mode, or beginning with 0.01 heaps within the customized lot dimension mode, till the backtest and stay buying and selling synchronize, then modify the danger worth. On the similar time, we will see that the trades on the prime of the picture are higher than these on the backside. Due to this fact, we can’t conclude that being out of sync is essentially unhealthy, and we do not have to intentionally pursue synchronization.