Hello Merchants,

Lots of you requested for Quant Analyzer Portfolio Outcomes, so I’m importing it right here and everyone can analyze them, and make good choices primarily based on them.

The EA: https://www.mql5.com/en/market/product/122633?supply=Website+Profile+Vendor

Our web site: https://nomadforexrobots.com/

I need to spotlight the unimaginable worth of utilizing Quant Analyzer studies for assessing the chance and total efficiency of our Professional Advisors (EAs). These studies are usually not simply one other software; they’re important for making knowledgeable buying and selling choices and optimizing our methods. Right here’s why they’re so essential:

1. Complete Threat Evaluation

Quant Analyzer studies present an in depth view of the chance related to every EA. They provide insights into crucial metrics akin to Most Drawdown and Worth at Threat (VaR). These metrics assist us perceive how a lot threat we’re taking and what potential losses might seem like in adversarial circumstances. By analyzing this information, we are able to higher handle our threat publicity and regulate our methods to guard our capital.

2. In-Depth Efficiency Metrics

The studies break down efficiency metrics in a manner that goes past easy revenue and loss. We get detailed info on win/loss ratios, commerce frequency, and revenue distributions. This stage of element helps us assess not simply how a lot our EA is making, but additionally how constant and dependable its efficiency is. It’s important for figuring out strengths and weaknesses in our buying and selling methods.

3. Historic Efficiency Evaluation

One of many standout options of Quant Analyzer is its means to research historic efficiency. By reviewing how our EA has carried out in varied market circumstances over time, we achieve beneficial insights into its potential future efficiency. This historic perspective helps us decide if the EA’s success is sustainable or if it is dependent upon particular market circumstances which may change.

4. Sturdy State of affairs and Stress Testing

Quant Analyzer permits us to simulate completely different market situations and stress-test our EAs. This implies we are able to see how our methods would possibly carry out beneath excessive circumstances, which is essential for understanding their robustness. Stress testing helps us put together for potential market shocks and ensures that our EAs are able to dealing with surprising volatility.

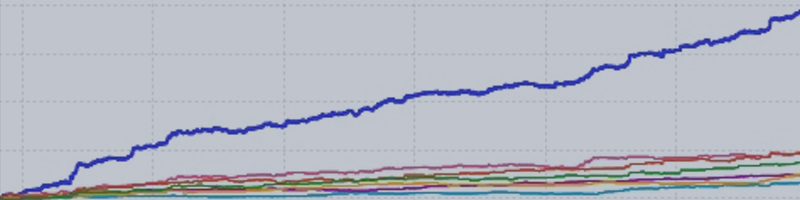

5. Visible Insights

The studies include highly effective visualization instruments, together with charts and graphs. These visible aids make complicated information extra accessible and simpler to interpret. By reviewing fairness curves, drawdown charts, and different visible metrics, we are able to shortly determine developments and areas that want consideration.

6. Knowledgeable Resolution-Making

General, Quant Analyzer studies assist extra knowledgeable decision-making. They supply the info and insights we have to refine our buying and selling methods, handle threat extra successfully, and enhance our total strategy. As an alternative of relying solely on instinct, we are able to base our choices on empirical proof and complete evaluation.