EUR/USD: Three Weeks of Uncertainty

● The conferences of the Central Banks have been held strictly in keeping with plan final week. As anticipated, the important thing fee was raised by 25 bps (foundation factors) on the US Federal Reserve assembly and reached 4.75%, and by 50 bps on the European Central Financial institution assembly, as much as 3.00%. For the reason that selections themselves didn’t deliver surprises, market individuals targeted on the regulators’ plans for the longer term.

● The following assembly of the FOMC (Federal Open Market Committee) of the US Federal Reserve won’t be held quickly: on March 22, that’s, in nearly two months. Markets are more likely to anticipate that it’s going to announce one other fee hike by 25 bps to five.00%, after which it should maintain it at this degree.

The DXY Greenback Index fell to a brand new 9-month low of 100.80 on Thursday, February 02. This occurred after the Federal Reserve made it clear that the tip of the wave of fee hikes was close to. Statistics present that the regulator’s efforts to unravel financial issues are yielding outcomes: the inflation fee was 9.1% (the very best determine in 40 years) in June, and it fell to six.5% in December. This makes it doable to place the brake on quantitative tightening (QT). Buyers understood the dovish hints of the top of the Fed, Jerome Powell, who, throughout the press convention following the assembly, admitted for the primary time that “the deflationary course of has begun.” He additionally assumed that the height fee wouldn’t exceed 5.00% and reiterated that the US Central Financial institution can obtain a slowdown in inflation with out inflicting important harm to the economic system.

● As for the Eurozone, inflation, as proven by knowledge for January, has been falling for the third month in a row. However the fundamental value enhance stays on the similar degree, regardless of the autumn in power costs. In accordance with forecasts, inflation within the Eurozone is predicted to succeed in 5.9% in 2023, to fall to 2.7% in 2024, and to fall even decrease to 2.1% in 2025. Unemployment development can also be projected to say no additional, whereas GDP development expectations stay on the similar degree. In accordance with preliminary knowledge printed on Wednesday, February 01, the expansion of the European economic system can be 1.9% in 2022, which is decrease than the earlier worth (2.3%), however increased than the forecast (1.8%).

Following the final assembly, ECB President Christine Lagarde mentioned that the dangers to each financial development and inflation within the Eurozone have develop into extra balanced. And that the ECB will assess financial growth after the following fee hike in March. (Additionally it is anticipated to be 50 bps). When requested about the opportunity of additional fee hikes after March 16, Ms Lagarde shunned making any commitments. This put downward strain on the euro, and EUR/USD rotated and went down with out rising above 1.1031.

● The greenback acquired a further increase of energy after the publication of spectacular knowledge from the US labor market on Friday, February 03. Information launched by the Bureau of Labor Statistics (BLS) confirmed that the nation’s unemployment fee, as an alternative of the anticipated enhance to three.6%, fell from 3.5% to three.4%, and the variety of jobs created outdoors the agricultural sector (NFP) in January elevated by 517Ok, which is 2.Eight occasions increased than the 185Ok forecast, and nearly twice increased than December’s 260Ok development.

● In consequence, EUR/USD completed at 1.0794. Recall that it ended the week at 1.0833 on Friday, January 13, at 1.0855 on January 20, and at 1.0875 on January 27. This proximity of all these values (inside 100 factors) means that the market has not acquired clear indicators about the place it ought to goal within the foreseeable future. Though, on the time of writing the overview (Friday night, February 03), the US foreign money has a sure benefit.

Economists at Singapore’s monetary UOB Group counsel that the euro isn’t but prepared to maneuver in the direction of the resistance of 1.1120, and the pair could commerce within the vary of 1.0820-1.1020 for the following 1-Three weeks. As for the median forecast, 45% of analysts anticipate additional strengthening of the euro, the identical quantity (45%) anticipate the greenback to strengthen, and the remaining 10% have taken a impartial place. The image is completely different among the many indicators on D1. 35% of the oscillators are coloured crimson (one third of them are within the oversold zone), 25% are wanting up and 40% are coloured grey impartial. As for development indicators, 50% suggest shopping for, 50% promoting. The closest assist for the pair is within the zone 1.0740-1.0775, then there are ranges and zones, 1.0700-1.0710, 1.0620-1.0680, 1.0560 and 1.0480-1.0500. The bulls will meet resistance on the ranges of 1.0800, 1.0835-1.0850, 1.0895-1.0925, 1.0985-1.1030, 1.1120, after which they may attempt to achieve a foothold within the 1.1260-1.1360 echelon.

● Subsequent week’s calendar could mark Monday February 06, when preliminary knowledge on shopper costs in Germany and remaining knowledge on January retail gross sales within the Eurozone can be printed. Fed Chairman Jerome Powell is predicted to talk on Tuesday. The ultimate knowledge on inflation (CPI) in Germany and unemployment within the US will arrive on Thursday, February 09. And the worth of the Client Confidence Index from the College of Michigan USA can be recognized on Friday, February 10.

GBP/USD: Riddles from BoE

● The well-known London fog continues to haze the financial coverage of the Financial institution of England (BoE). Just like the ECB, this regulator raised the important thing fee by 50 bp. to 4.00% on Thursday, February 02, however on the similar time it softened its message noticeably. This pushed the British foreign money again from its highs since mid-June 2022. values (1.2450) down, to the extent of 1.2100. On the week’s low, after the publication of the US NFP, the GBP/USD pair traded even decrease at 1.2046, and ended the five-day interval nearly there, at 1.2050.

● As already talked about, the way forward for the UK’s funds is obscure and unsure. Now we have tried to make sense of what the chief economist mentioned BoE Hugh Tablet, giving an interview for Occasions Radio on Friday February 03. Listed here are only a few quotes. “We should admit that we’ve got already achieved rather a lot” – “There are numerous extra steps within the pipeline.” “Quite a lot of information tales have improved just lately” – “We have to be ready for shocks.” “Now we have a reasonably excessive diploma of confidence that inflation will fall this 12 months” – “The main focus is on whether or not inflation will fall additional.” And just like the icing on the cake, Hugh Tablet’s comment that it is necessary for the Financial institution of England to not do “an excessive amount of” in financial coverage…

● To be sincere, we have been unable to find out from this assertion the place the road between “little”, “a lot” and “an excessive amount of” is drawn. Due to this fact, right here is the opinion of Commerzbank strategists. “It has develop into clear that the Financial institution of England is nearing the tip of its fee hike cycle,” they conclude. And so they proceed: “Whereas the Financial institution of England has left the door open for additional fee hikes, a extra assertive method could be fascinating from a foreign money market perspective resulting from excessive uncertainty. In opposition to this background, it’s not stunning that the sterling has weakened, and its additional decline appears more likely to us.”

● This perspective of Commerzbank economists has been supported by 55% of analysts, who additionally “thought possible” an extra fall in GBP/USD. The alternative view is held by 45% of specialists. Among the many development indicators on D1, the stability of energy is 75% to 25% in favor of the reds. Among the many oscillators, the reds win as properly: their benefit is 85% versus 15%. Nonetheless, among the many reds, 20% indicators that the pair is oversold. Help ranges and zones for the pair are 1.2025, 1.1960, 1.1900, 1.1800-1.1840. When the pair strikes north, it should face resistance on the ranges 1.2085, 1.2145, 1.2185-1.2210, 1.2270, 1.2335, 1.2390-1.2400, 1.2430-1.2450, 1.2510, 1.2575-1.2610, 1.2700, 1.2750 and 1.2940.

● Among the many developments relating to the UK economic system within the coming week, Friday 10 February will entice consideration with the discharge of UK GDP knowledge for the previous 2022. It’s anticipated that, regardless of some development in This fall (from -0.3% to 0.0%), the annual fee will present a drop from 1.9% to 0.4%.

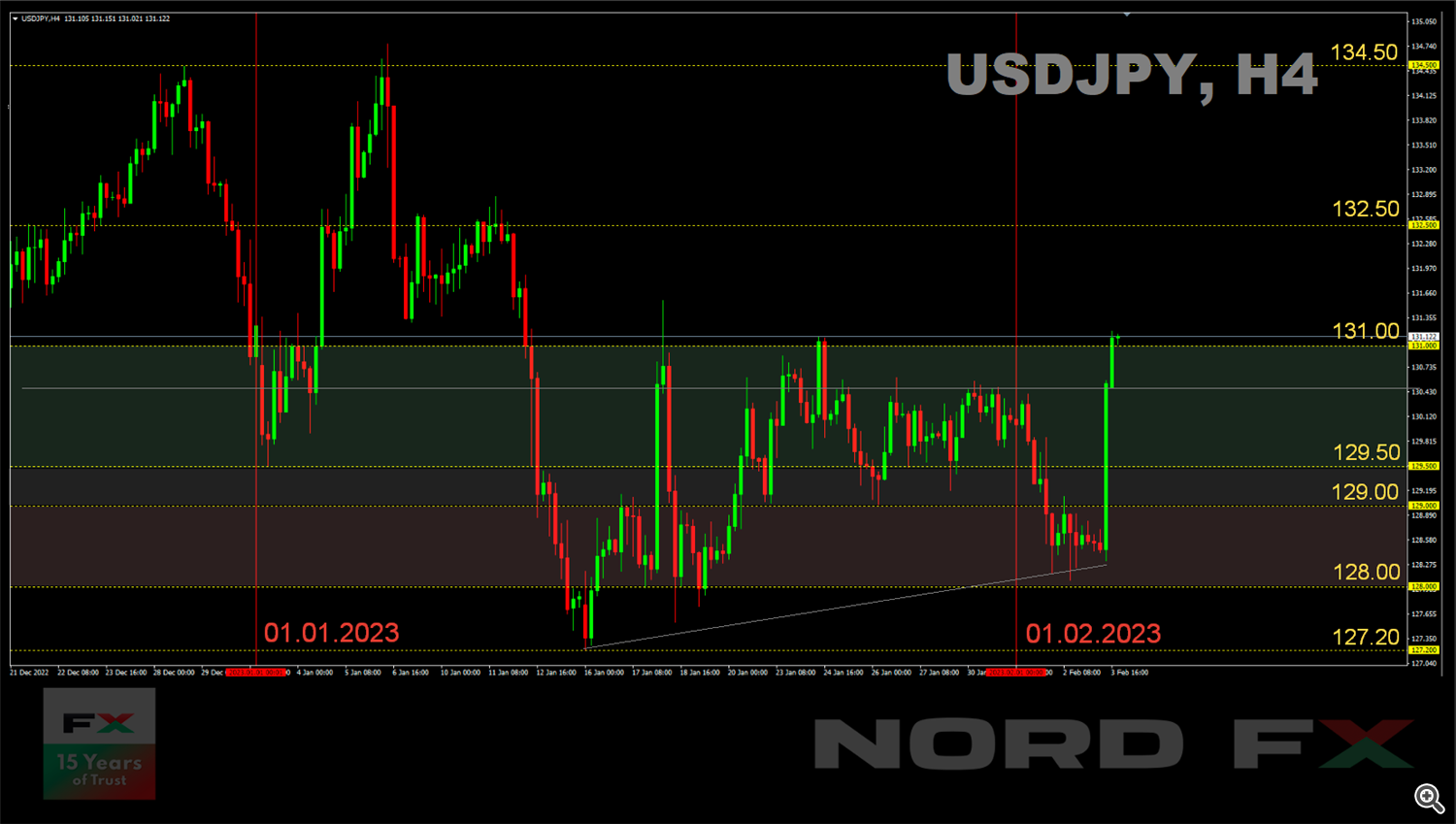

USD/JPY: Non-Farm Payrolls Knocks the Yen Down

● Typically, the Japanese yen moved in the identical method as its counterparts towards the greenback final week, the euro and the British pound. Nonetheless, its volatility was virtually not affected by the choices of the ECB and the Financial institution of England. On this case, the figuring out issue was the distinction between rates of interest on the greenback (+4.75%) and the yen (-0.1%). In consequence, having discovered an area backside at 128.08, USD/JPY moved sideways after the Fed assembly, and knowledge from the US labor market (NFP) despatched it on an area flight on Friday, with a size of virtually 300 factors, to the peak of 131.18. The flight of buyers from the greenback to the secure haven of Japan has stopped, they usually have once more determined to decide on the American foreign money as a secure haven. USD/JPY set the final chord of the week on the degree of 131.12.

Markets will now anticipate March 10 for the present Financial institution of Japan (BoJ) Governor Haruhiko Kuroda to carry his final assembly. His powers will finish on April 8, and the assembly of the BoJ on April 28 can be held by the brand new head of the Central Financial institution. It’s with this occasion that the markets affiliate a doable change within the financial coverage of the regulator. Though, till that second, interventions from the BoJ, comparable to those who the regulator undertook in October-November 2022, can’t be dominated out to cease the autumn of the nationwide foreign money.

● Up to now, analysts’ forecasts don’t present any clear tips: 40% of them facet with the bulls, 40% with the bears, and 20% have determined to not make predictions in any respect.

Among the many oscillators on D1, 75% level north (15% are within the oversold zone), 15% look south and 10% look east. For development indicators, 50% look north, precisely the identical quantity in the wrong way. The closest assist degree is situated at -130.85 zone, adopted by the degrees and zones of 130.50, 129.70-130.00, 128.90-129.00, 128.50, 127.75-128.10, 127.00-127.25 and 125.00. Ranges and resistance zones are 131.25, 131.65, 132.00, 132.80, 133.60, 134.40 after which 137.50.

● No necessary occasions relating to the Japanese economic system are anticipated this week.

CRYPTOCURRENCIES: BTC Has Change into a Threat Protecting Asset

● The previous week proved as soon as once more that the highest cryptocurrencies, and primarily bitcoin, have lengthy ceased to be impartial. Their quotes, in addition to dangerous belongings on the whole, are firmly tied to the choices of the US Federal Reserve: the US greenback is on the other facet of the dimensions in BTC/USD. If it weakens, bitcoin will get heavier, and vice versa. In fact, selections by different regulators, such because the ECB or the Folks’s Financial institution of China, additionally affect the value of digital belongings, and inner crises such because the FTX collapse may additionally shake it up. However the Fed remains to be the principle development creator of BTC/USD.

● Bitcoin remains to be a tremendous asset. It managed, as they are saying, to take a seat on two chairs final 12 months. On the one hand, its correlation with the inventory market and inventory indices S&P500, Dow Jones and Nasdaq permits it to be labeled as a dangerous asset. However then again, analysts on the crypto media web site CryptoSlate draw consideration to the correlation of cryptocurrency with… gold, which has been thought-about insurance coverage towards inflation and different monetary dangers since historic occasions. The coincidence in motion between the 2 belongings has reached, in keeping with CryptoSlate, an absolute most, 83% since February 2022. It seems that bitcoin is each a dangerous and protecting asset on the similar time. As they are saying, a buddy amongst strangers and a stranger amongst buddies.

● In accordance with Goldman Sachs economists, even after adjusting for threat, bitcoin has already considerably outperformed gold, inventory markets and the true property sector when it comes to profitability and continues to take action. The principle cryptocurrency is now displaying its finest begin to the 12 months since January 2013. Its fee rose by 51% then, the expansion was 40% final month. It occurred towards the backdrop of the weak point of the US greenback. “On the similar time, 85% of the contribution to the rally is related to buyers from the USA,” says Markus Thielen, head of analysis at crypto companies supplier Matrixport. The bullish stance of US corporations can also be confirmed by the renewed premium in bitcoin futures listed on the Chicago Mercantile Trade. Open curiosity in BTC futures on the Chicago Mercantile Trade (CME) is considerably outperforming the value, with a 77% month-on-month rise to $2.Three billion. “We interpret this as an indication that sooner institutional merchants and hedge funds are actively shopping for again the latest fall within the cryptocurrency markets,” Thielen mentioned.

Deutsche Digital Property made an analogous statement earlier, on January 20, drawing consideration to the rise in Coinbase’s premium as proof of elevated shopping for curiosity from subtle US institutional buyers.

● A survey by monetary advisory agency deVere Group confirmed that regardless of the challenges of 2022, 82% of millionaires have been contemplating investing in digital belongings. Eight out of 10 surveyed shoppers of the corporate, with belongings to take a position from $1.2 to $6.1 million, turned to monetary advisers for cryptocurrency recommendation.

Nigel Inexperienced, CEO and Founding father of the deVere Group, believes that whereas the group surveyed is “typically extra conservative,” its curiosity stems from the core values of bitcoin: “digital, international, borderless, decentralized, and safe from unauthorized entry”. Inexperienced additionally notes a rising curiosity in crypto companies from older monetary establishments resembling Constancy, BlackRock and JPMorgan, and considers this signal for the trade. He predicts that the momentum of curiosity will construct because the “crypto winter” of 2022 thaws resulting from altering circumstances within the conventional monetary system. (For reference, a June 2022 Pricewaterhouse-Coopers report confirmed that roughly a 3rd of the 89 conventional hedge funds surveyed had already invested in digital belongings.)

● Comparable outcomes have been obtained by analysts from Pureprofile. Their research concerned 200 institutional buyers and asset managers from the US, the EU, Singapore, the UAE and Brazil. The entire quantity of funds managed by respondents was $2.85 trillion. 9 out of ten buyers within the survey have been in favor of the expansion of the flagship cryptocurrency in 2023, and 23% consider that the worth of BTC will exceed $30,000 by the tip of the 12 months. In the long term, 65% of respondents agree that the coin will break the $100,000 mark.

● Not solely whales, but additionally smaller buyers stay optimistic, regardless of the dramatic occasions of the final 12 months. In accordance with statistics, the entire variety of digital wallets with a stability of $1,000 or extra in bitcoin or ethereum elevated by 27% in 2022. In accordance with the survey, greater than 88% of Binance crypto change clients plan to proceed investing in cryptocurrencies, and solely 3.3% don’t think about this chance. Bitcoin remains to be the dominant asset, owned by 21.7% of these surveyed.

Over 40% of respondents purchased digital belongings final 12 months for funding functions. Different motives have been the decline within the worth of bitcoin and the final bearish development. Virtually 8% cited the geopolitical state of affairs on the earth as a purpose for the acquisition, and 11.5% expressed mistrust of the standard monetary system. 40.8% don’t use conventional funding alternatives (shopping for shares, investing in actual property, mutual funds), whereas 32.4% do use them. On the similar time, 79.7% are certain that cryptocurrencies are crucial for the event of the worldwide economic system, and 59.4% of respondents consider that deposits in cryptocurrencies will be capable to change financial institution deposits over time.

● Galaxy Digital Holdings Ltd founder billionaire Mike Novogratz, having weathered a difficult 2022, is now dedicated to long-term funding in bitcoin mining with a $65 million acquisition of a Helios mining facility in Texas, USA. And in keeping with estimates by a well-liked analyst aka Plan B, recognized for his “Inventory-to-Stream” mannequin, the value of bitcoin will attain $1 million by 2025, which can greater than recoup Mike Novogratz’s prices. As for this 12 months, Plan B expects it to rise above $100,000. The analyst additionally mentioned that the January bitcoin pump confirms that the asset’s 4-year cyclical value backside is over.

● In accordance with historic observations by Matrixport specialists, whereas January bitcoin quotes have been within the “inexperienced” zone on the chart (they usually have been there), the value rally normally continued within the following months of the 12 months. Primarily based on this, they predict that the flagship cryptocurrency may attain $45,000 by Christmas 2023.

● And the well-known cryptocurrency dealer Peter Model considers the bulls’ pleasure somewhat untimely and sticks to the bearish forecast for the close to future. Because the knowledgeable famous, many merchants and buyers at the moment are ready for a sure pullback with a view to enter the market at higher costs. The specialist believes that the flagship of the crypto market could attain the extent of $25,000 within the close to future, after which there can be a correction nearer to $19,000. Nonetheless, within the medium time period, Model remains to be optimistic and predicts bitcoin to rise to $65,000 in the course of this 12 months.

● Crypto analyst Benjamin Cowen, who mentioned that bitcoin has a “lengthy 12 months” forward of time, additionally warns towards untimely glee. In accordance with the knowledgeable, it could seem that BTC has important energy, whereas in actual fact the asset is more likely to be within the means of forming a large sideways vary as a base. Cowen defined that sideways motion isn’t all the time an indicator of the expansion of the primary cryptocurrency and may additionally sign a fall in quotes.

The analyst reminded merchants {that a} bearish cycle is normally adopted by a 12 months of sideways motion. Thus, there have been three upward impulses in 2015, and solely the final one changed into an actual rally. There have been additionally intervals of development in quotes in 2019, then their energetic fall adopted, and a cycle that introduced the crypto market to new highs began solely after that. Cowen famous that 2023 could be seen as a 12 months of accumulation and that buyers can benefit from this era to extend their holdings of BTC. In addition, he believes that the US Federal Reserve ought to ease financial coverage for cryptocurrency costs to develop. (The final assembly of the regulator provides hope for this).

● On the time of penning this overview (Friday night, February 03), BTC/USD is buying and selling within the $23,400 zone. The entire capitalization of the crypto market is $1.082 trillion ($1.060 trillion every week in the past). The Crypto Worry & Greed Index, a metric displaying the final perspective of the neighborhood in the direction of bitcoin, entered the Greed zone for the primary time since March 30, 2022, reaching 60 factors (55 every week in the past). It’s clear that that is as a result of development of the coin fee within the first month of the 12 months and the final revival of the market. It’s value noting, nevertheless, that the elevated confidence amongst crypto buyers shouldn’t be instantly considered as a catalyst for the resumption of bullish development within the bitcoin value. In actual fact, a Worry or Excessive Worry metric may point out shopping for alternative, and too excessive a Greed studying may imply the market is headed for a downward correction.

● And on the finish of the overview, our half-joking column of crypto life hacks. This time we need to draw the eye of BTC holders to Nigeria. It seems that that is the place you may earn. Information releases say that the value of bitcoin on the favored NairaEX change on this nation, when it comes to native foreign money, jumped to nearly $40,000, which is about 70% increased than the worldwide market quotes. Because it turned out, the discrepancy is as a result of restrict imposed by the Central Financial institution of Nigeria on withdrawing funds from ATMs. So, girls and gents, don’t forget about arbitrage offers, they will additionally deliver good earnings. The principle factor is to know what, the place, when and at what value to purchase after which promote.

NordFX Analytical Group

Discover: These supplies aren’t funding suggestions or tips for working in monetary markets and are meant for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in an entire lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx