Obtain Demo:

Abiroid_Scanner_GMMA_Trend_Demo_v2.2.zip- 2.2

Word: Demo solely works for Three pairs.

Essential Hyperlinks:

Accessible for buy right here:

https://www.mql5.com/en/market/product/38747

Get the free GMMA Arrows Indicator which works on a single Image/Timeframe right here:

https://www.mql5.com/en/market/product/42908

You’ll be able to learn extra about GMMA (Guppy System of Buying and selling) right here:

https://abiroid.com/indicators/guppy-arrows-indicator

Learn Frequent Scanner Settings described right here:

https://www.mql5.com/en/blogs/put up/747456

About Scanner Technique:

How GMMA Traces are calculated:

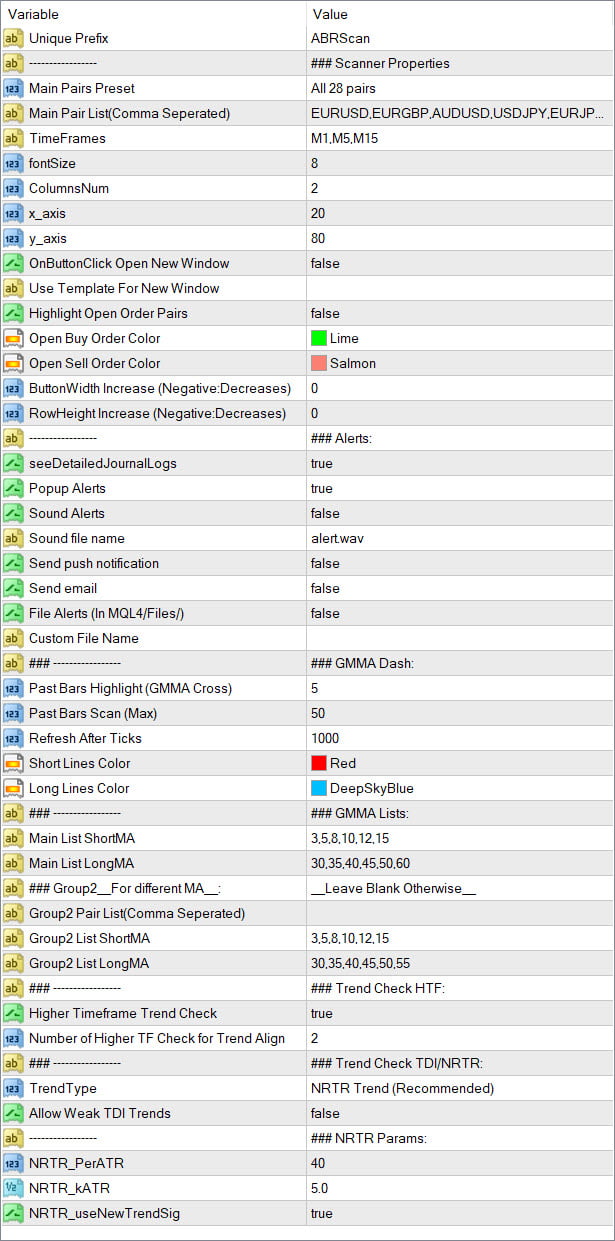

Foremost Record ShortMA is used to calculated Quick MA traces by default and Foremost Record LongMA is used for Lengthy MA traces.

However for some pairs, you would possibly want completely different MA intervals. So you should use Group2 Pair Record for including comma separated record of these pairs.

And specify the comma separated Quick and Lengthy MA lists for Group2.

The Checks:

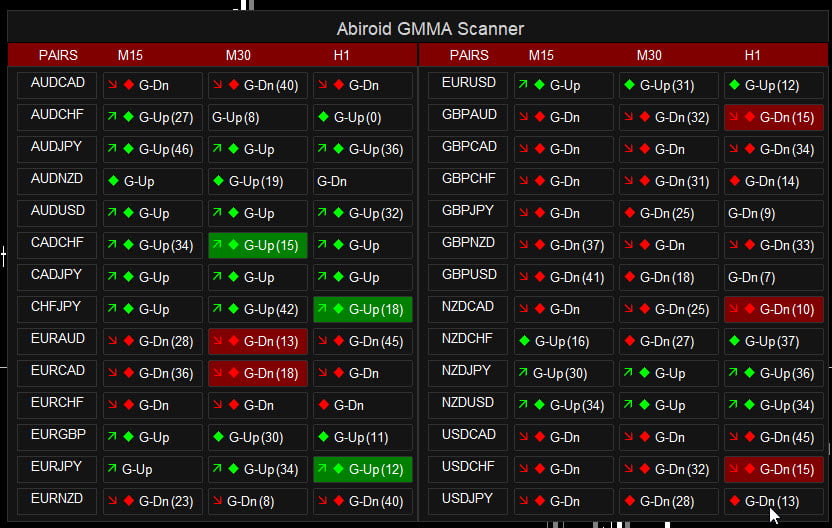

1- Present TF GMMA Cross and Pattern (Necessary Examine.. G-Up/G-Down)

Examine for GMMA Cross. When brief GMMA traces cross lengthy GMMA traces upwards, the pattern is Bullish proven by G-Up.

When brief GMMA traces cross lengthy GMMA traces downwards, the pattern is Bearish proven by G-Dn (G-Down).

The quantity in brackets are what number of bars again the cross occurred.

Previous Bars Scan (Max): Variety of complete previous bars to scan for a cross

Previous Bars Scan (Spotlight): Default: 5. So, if variety of bars is 5 or much less and all circumstances meet (2 or Three non-obligatory if true), spotlight that block (Purple for Bearish and Inexperienced for Bullish).

2- HTF GMMA Pattern Examine (Optionally available.. slanting arrow)

If Larger Timeframe Pattern Examine is true and “Variety of HTF Examine Pattern Align” is 2. Then test 2 HTF for GMMA Pattern alignment.

3- TDI or NRTR Pattern Examine (Optionally available.. diamond)

From Pattern drop-down choose:

- None: No Pattern Detection

- NRTR: Use this NRTR indicator to detect if pattern is Up/Down:

- TDI: Use this TDI indicator to detect Pattern Up/Down. TDI is a bit heavy and CPU intensive. So in case you are utilizing all 28-pairs, then I’d advocate not utilizing it. As it would give reminiscence points and also you would possibly get Array Out of Vary errors.

Indicator Settings:

NRTR Params:

Modify kATR worth to make NRTR SR Traces nearer or additional aside.

If NRTR Thick Purple Line is above worth, it means pattern is downwards. If blue NRTR Thick line is under worth, it means pattern is Upwards.

TDI:

If utilizing TDI, you’ll be able to specify Enable Weak TDI Tendencies true/false. If false, it’ll solely use the robust TDI Tendencies. If true, it’ll additionally use the weak tendencies.

Finest buying and selling kind:

Default settings are the most effective for M15+ and better timeframes. And they’re good for long run pattern based mostly buying and selling. GMMA shouldn’t be good for brief time period scalping. In case you are in search of scalping instruments, strive one thing like reversal based mostly buying and selling.